Euro Zone’s Underlying Price Surge Is Now Key ECB Battleground

The threat to the euro zone from surging underlying inflation has become the European Central Bank’s main intellectual battleground as interest-rate hiking enters a new phase of constricting the economy.

Article content

(Bloomberg) — The threat to the euro zone from surging underlying inflation has become the European Central Bank’s main intellectual battleground as interest-rate hiking enters a new phase of constricting the economy.

Advertisement 2

Article content

The core measure of consumer-price growth that excludes volatile items like food and energy set a new record of 5.6% last month, with the durability of that spike and the danger it poses now primary focuses for officials who meet in two weeks to set borrowing costs.

Article content

The jump in that gauge was the biggest eyeopener in Thursday’s euro-area inflation release — the culmination of a string of faster-than-anticipated outcomes from the region’s largest economies. Investors have piled on bets this week for future rate increases, pricing in a 4% peak for the first time.

Within hours of the euro-zone data, an account of the Feb. 2 ECB decision showed an intensified focus on core inflation. That specific term was cited 23 times in the write-up of the meeting — twice as much as in December — with what’s likely to have been the dovish minority arguing against focusing on it too much.

Article content

Advertisement 3

Article content

“We now expect the ECB to keep hiking until June,” Jamie Rush and David Powell of Bloomberg Economics said in a report. “By then, core inflation should be on a firmly downward trajectory, creating space for President Christine Lagarde and her colleagues to take stock. The risk is that sticky core inflation means borrowing costs are taken further into restrictive territory.”

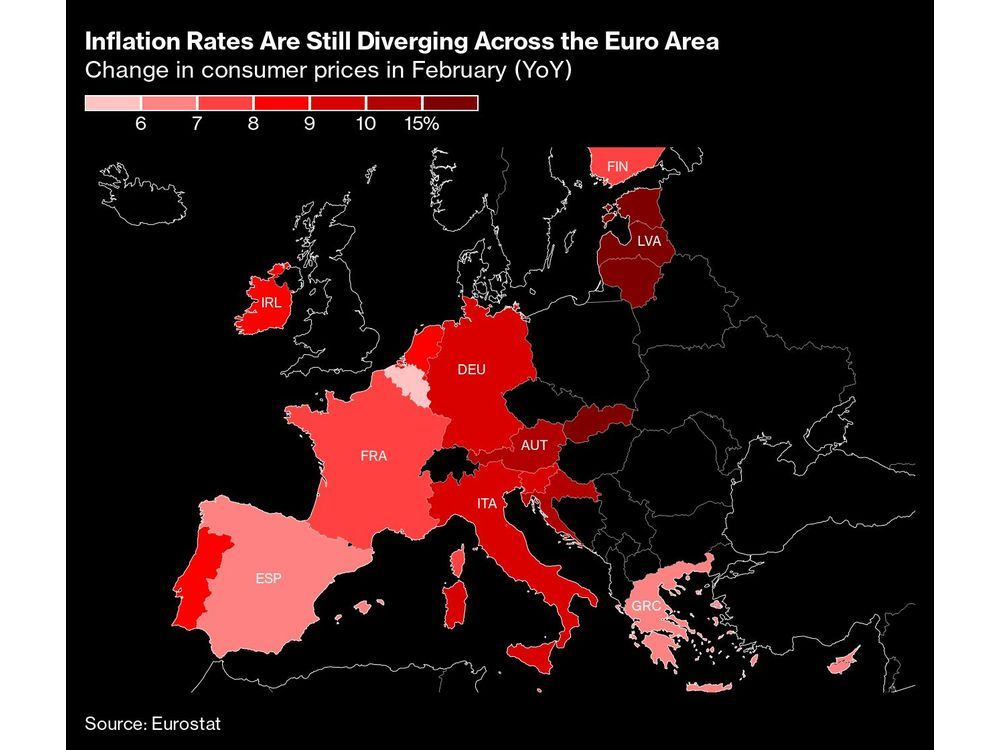

The underlying measure was only one element in a consumer-price report that offered little grounds for complacency at the ECB. Headline inflation slowed only slightly to 8.5%, above economist forecasts compiled last week that were quickly overshadowed by surprisingly high outcomes in Germany, France, Italy and Spain.

Given that backdrop, and the financial-market reaction of predicting further rate hikes, the ECB account also showed a sanguine view on the danger of pushing too far.

Advertisement 4

Article content

“It was generally felt that concerns of ‘overtightening’ were premature,” the account said. “Given the still substantial distance to the prospective terminal rate, there continued to be value – from a risk management perspective – in frontloading.”

What’s more, officials said, even the current level of borrowing costs — after 300 basis points of hikes — probably isn’t acting as much of a brake on economic expansion.

“Policy rates were, at present, barely consistent with the range of estimates for the neutral rate,” according to the discussion’s write-up, referring to the rate that neither stimulates nor restricts growth.

A year since Russia’s invasion of Ukraine upended the continent’s political and economic status quo, officials are now starting to reverse the bond purchases that helped soothe past crises — just as their next rate moves start constraining the economy.

Advertisement 5

Article content

New projections due at the March 16 decision will be key in guiding that approach. Executive Board member Isabel Schnabel said Thursday in a speech that maintaining a large asset portfolio may hinder inflation-fighting efforts.

Beyond concrete ECB action, the annual nature of consumer-price data means last year’s upswing in energy costs will soon provide meaningful downward pressure on the headline gauge. The impact of rate hikes on economic expansion may also begin to materialize, dampening demand.

Whether wages pick up in the meantime — perhaps heralded by core-price increases — will therefore be a closely watched thing. All along, the question for officials will be how much damage to growth they need to inflict before the shock can be definitively tamed.

“There’s no free lunch — I mean in order to bring inflation down, there’s no historic experience of inflation coming down without some cost to be paid,” former ECB Executive Board member Lorenzo Bini Smaghi, now chairman of Societe Generale SA, told Bloomberg Television. Even so, “once the economy slows down, it’s going to be very difficult for central banks to continue to increase rates.”

—With assistance from Alexander Weber and Francine Lacqua.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation