Debt crunch looms, but nobody knows how much is too much

Debt doomsday predictions flowed fast and furious a decade ago.

The Pentagon labeled the federal debt a national security threat, while economists pointed to red lines that, if crossed, would send the government into a debt tailspin.

Some pegged the tripwire to the point where Uncle Sam’s debt crossed 80% of gross domestic product. Others gave more leeway but said the situation would go south at the 100% debt-to-GDP ratio.

The U.S. has blown through all of those benchmarks and shows no sign of stopping.

Now, as another debt fight looms on Capitol Hill, some experts say the fretting over the size of the government’s credit card is premature.

“In recent years, the notion that there’s some tipping point at which debt becomes a serious economic problem has lost credence. Similarly, the capacity to carry government debt appears to be greater than previously thought,” said Paul Van de Water, a senior fellow at the Center on Budget and Policy Priorities, a left-leaning economic think tank.

The government’s total debt, at $31.5 trillion, is bumping up against the current borrowing limit imposed by Congress. The Treasury Department is using other pots of money, such as some allocated for retirement accounts, to pay the bills. It probably will run out of room sometime this summer.

Leaders in the House Republican majority say any borrowing increase must be coupled with reforms to alter the trajectory of spending.

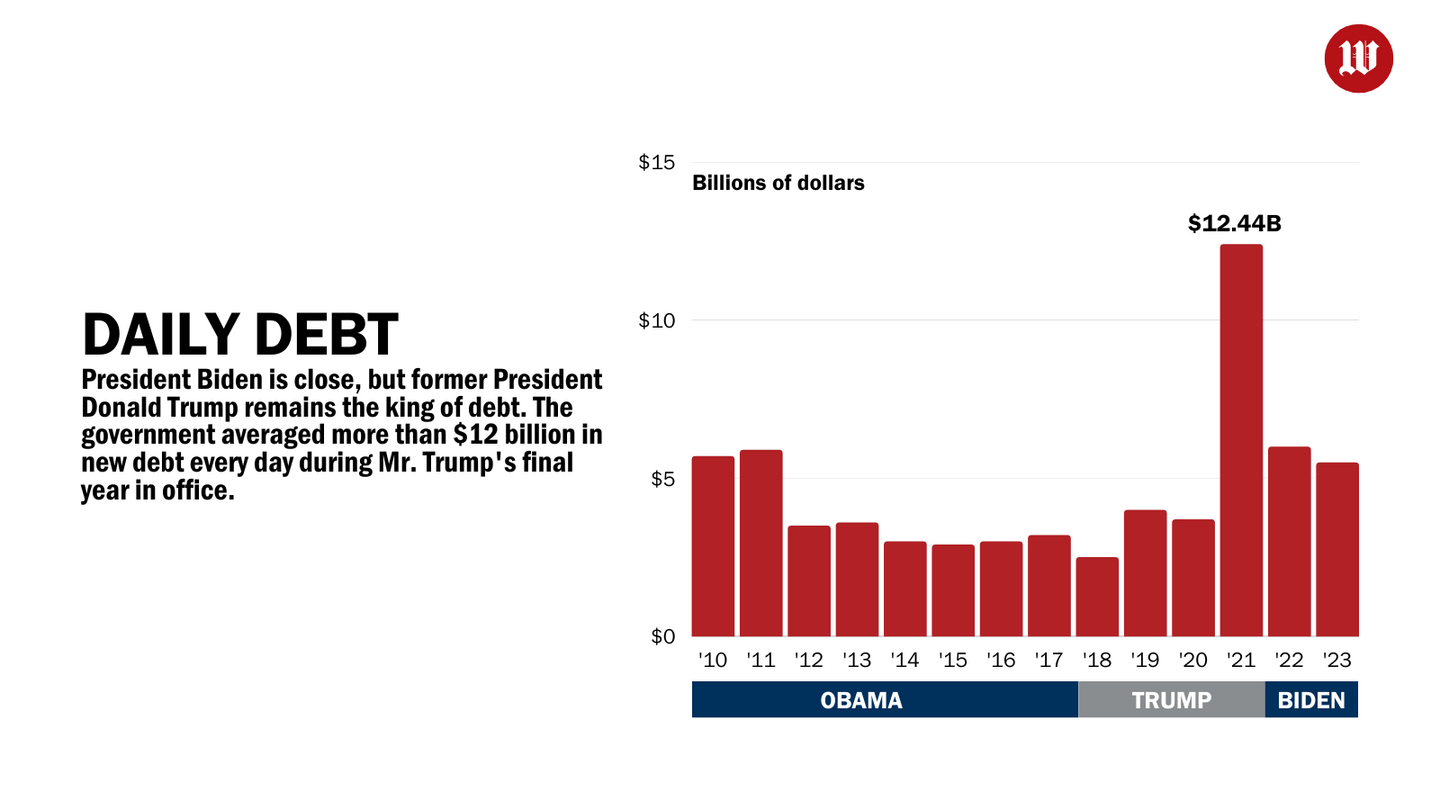

Democrats counter that the debt limit is a poor fight to have, given that the faith and credit of the U.S. government rests on paying its bills. They also bristle at lectures about spending by a party whose leader, former President Donald Trump, set the record for the most debt accumulated per year.

Both sides seem to agree that rising debt is troubling, though they — and economists — struggle to figure out how high is too high.

The total debt-to-GDP ratio stands at about 120%. It reached 135% in the first months of the COVID-19 pandemic as the GDP plunged. Steady growth has brought down the figure, though the Congressional Budget Office says it will soon begin a steady march back uphill.

“Such high and rising debt could have significant economic and financial consequences. It could, among other things, slow economic growth, drive up interest payments to foreign holders of U.S. debt, elevate the risk of a fiscal crisis, increase the likelihood of less abrupt adverse effects, make the U.S. fiscal position more vulnerable to an increase in interest rates, and cause lawmakers to feel more constrained in their policy choices,” CBO said in an evaluation last year.

A decade ago, analysts went searching for that tipping point.

In a series of works, Kenneth Rogoff and Carmen Reinhart at Harvard University pointed to a 90% debt-to-GDP ratio as the point beyond which growth would suffer. Stephen G. Cecchetti, an economist at Brandeis University, figured that an 85% debt ratio would begin to damage the economy.

In a 2013 paper, David Greenlaw, James D. Hamilton, Peter Hooper and Frederic S. Mishkin argued that countries that crossed an 80% debt-to-GDP ratio risked “rapid fiscal deterioration as a result of these tipping-point dynamics.”

The U.S. passed those levels years ago without falling into that sort of catastrophic spiral.

It’s not just the U.S. Japan’s debt-to-GDP ratio has topped 250%. France and Canada both stand just above 110%, according to the International Monetary Fund, and the United Kingdom hovers around 100% of debt to GDP.

So what happened?

Mr. Mishkin didn’t respond to an inquiry, and Mr. Hamilton declined to comment on their projections.

Mr. Cecchetti, in an email, pointed to a piece he wrote in 2020 at the start of the pandemic in which he said investors have shown a persistent level of trust in fiscal policymakers and have been more eager to finance deficits than previously believed.

In particular, investors were willing to accommodate government spending splurges that propped up the globe’s major economies during the pandemic.

Yet he and colleague Kim Schoenholtz, writing at MoneyandBanking.com, warned that governments need to use the next economic expansion to consolidate fiscal space.

“Otherwise, when the next crisis hits, investors’ trust in advanced economy fiscal policymakers may not be sufficient to finance the massive deficits needed to speed the return to full employment,” they wrote.

Mr. Rogoff, whose paper was cited by top policymakers around the globe in pushing for austerity a decade ago, suggested that his research was misinterpreted.

“Our work simply suggested that as a group, countries with very high debt have, on average, about 1% lower growth than countries with under 100%. But there is no claim that growth falls suddenly going from 99% to 101% any more than having one’s cholesterol rise from slightly below to slightly above 200 has significance,” he said in an email.

“If one looks at the mediocre growth performance of many very high debt advanced countries over the past decade — think Italy and Japan — the correlation seems to have held up pretty well. Importantly, it is a correlation and not necessarily causal.”

Douglas Holtz-Eakin, who served as head of the CBO and is now head of the right-leaning American Action Forum, said he doubts there is a hidden tripping point that would send the U.S. on a fast spiral, similar to what Greece or Portugal experienced a decade ago.

Yet he sees validity in the findings that rising debt means sluggish growth.

“We’ve got debt at 100% of GDP, and we’re not growing all that well,” he told The Washington Times.

The issue with government debt is that it replaces private investment, and not in an efficient manner. Mr. Holtz-Eakin said that taking a dollar from private investment and putting it into Uncle Sam’s hands lowers the return by 50%, and that’s in a best-case scenario. More often, federal spending is consumption rather than investment.

As Congress embarks on its next debt fight, Mr. Holtz-Eakin said, both sides know that the borrowing ceiling needs to be raised.

“The disagreement is over the nature of our spending habits and what we’re going to do to correct it,” he said. “They shouldn’t run the risk of default over it, but it’s a conversation worth having.”

The tricky part for Capitol Hill is that both parties are eager about spending — just not the other guy’s version. Republicans want more money for security, while Democrats demand more social spending.

The deal Congress strikes usually gives both sides their spending and piles up debt for another generation to face.

Some Republicans have insisted that this time must be different.

During negotiations over electing the House speaker, members of the Freedom Caucus, a grouping of the most conservative House Republicans, pushed for spending caps that could slash tens of billions of dollars from the Pentagon’s accounts.

Other Republicans are trying to protect military spending, signaling that the alliance between big defense and big social spending will once again triumph over the debt-wary.

[ad_2]

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News