Australia Set to Raise Key Rate Even as Economic Impulse Softens

Australia’s central bank is set to raise interest rates for a 10th straight meeting on Tuesday, with policymakers facing a complex messaging task for an outlook of slower economic growth and still-elevated inflation.

Article content

(Bloomberg) — Australia’s central bank is set to raise interest rates for a 10th straight meeting on Tuesday, with policymakers facing a complex messaging task for an outlook of slower economic growth and still-elevated inflation.

Advertisement 2

Article content

Economists unanimously expect the Reserve Bank will increase its cash rate by a quarter-percentage point to 3.6% — a level not seen since May 2012. Attention will focus on whether Governor Philip Lowe persists with his guidance of further hikes ahead following weaker economic readings through February.

Article content

Australian policymakers meet as central banks grapple over when to conclude their tightening campaigns amid sticky inflation. Lowe is struggling to maintain a consistent message after the RBA considered a pause in December, turned hawkish in February following strong consumer price data and now has seen slower growth, well-contained wages and rising unemployment.

“The RBA may now be tightening policy into an economy that is already showing sufficient signs of softening,” said Gareth Aird, head of Australia economics at Commonwealth Bank of Australia. “That said, we wouldn’t be surprised if the RBA simply leaves their forward guidance unchanged for now.”

Article content

Advertisement 3

Article content

Lowe, who will speak Wednesday at a business conference, needs to navigate a path at a time of deep uncertainty. Aird said that “any subtle shifts” in the governor’s assessment of risks will likely come in the speech rather than Tuesday’s rate statement.

The RBA is waging its most aggressive campaign against inflation in a generation, having hiked by 3.25 points since May to take the cash rate to a 10-year high. Money markets are pricing a peak rate of 4.2% this year, suggesting at least three more quarter-point hikes to come.

But cracks are emerging in the A$2.2 trillion ($1.5 trillion) economy, where growth in the final three months of last year was primarily driven by trade, with consumption slowing and savings sliding.

Advertisement 4

Article content

Yet inflation remains high and the RBA saw signs of it broadening and deepening in the fourth quarter. The central bank did receive one piece of evidence last month that CPI has likely peaked after the latest monthly reading signaled a slowdown in price growth to 7.4% in January from 8.4% in December.

The monthly data also have shortcomings and the RBA won’t be confident on having turned the corner until it sees first-quarter data in late April.

A wildcard in the outlook is Australia’s rapidly thawing ties with China and the reopening of the world’s second-largest economy after Beijing abandoned Covid Zero. Australia is the most China-dependent economy in the developed world.

Lowe’s key challenge — as for central bankers across the world — is how high to push borrowing costs to bring inflation back to the RBA’s 2-3% target without tipping the economy into a recession.

Advertisement 5

Article content

South Korea held rates last month while keeping the door open to further hikes, and India is likely approaching a pause following a weak GDP reading.

The Federal Reserve has also slowed the pace of increases, while mulling a higher terminal rate to combat stubbornly high inflation, and the Bank of Canada has already said it’s moving to the sidelines.

What Bloomberg Economics Says…

“The RBA’s tightening bias is likely to remain in place until its next quarterly forecast review, in May. By then, we expect the data to show enough signs the economy is slowing to persuade the central bank that rates have gone high enough.”

James McIntyre, economist

To read the full report, click here

There are arguments for the RBA to stand pat as soon as April.

Advertisement 6

Article content

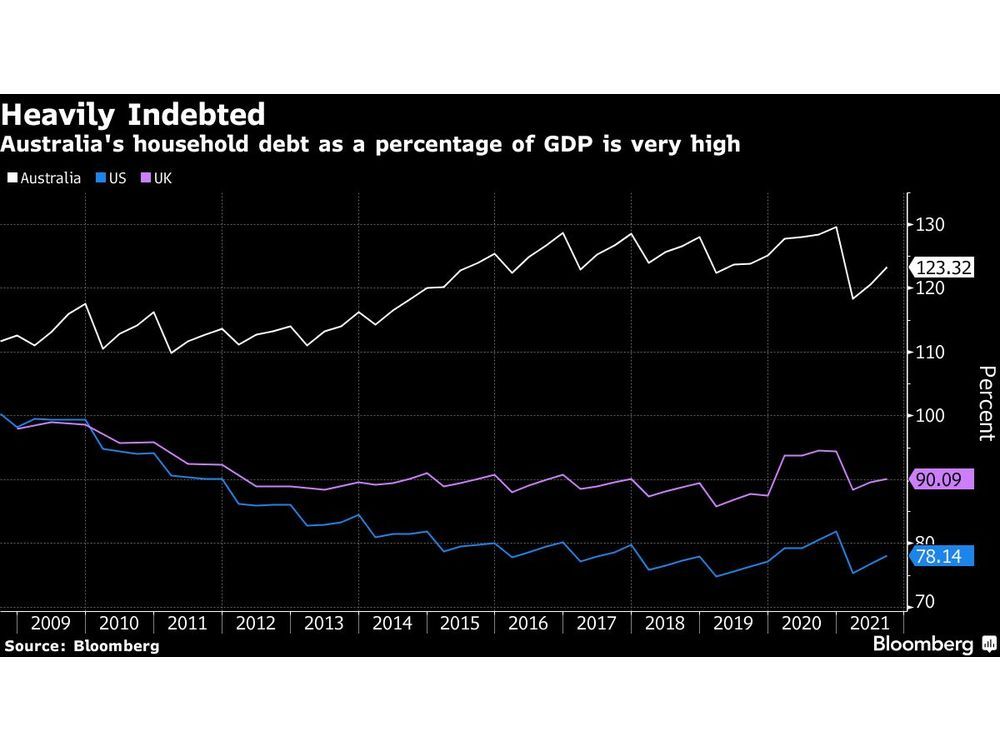

Australia’s heavily indebted households are running down savings to meet everyday living costs in response to higher prices and increased loan repayments. There are signs of rising mortgage stress and the latest corporate earnings, while mixed, point to more pain ahead.

“A significant increase in mortgage repayments is the biggest risk to household spending,” said Diana Mousina, a senior economist at AMP Capital Markets Ltd. “We think that the downside risks to the household sector are greater than the RBA — and most commentators — are estimating.”

The average Australian household has a mortgage of around A$600,000. As a rough guide, monthly mortgage repayments are due to increase by around A$13,000 per year, Mousina estimates.

“So the question then becomes whether households have enough cash flow to meet these additional repayments.”

—With assistance from Tomoko Sato and Garfield Reynolds.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation