China unveils new offshore IPO rules but big rebound unlikely, say law firms

Beijing has announced new rules for offshore listings by Chinese companies nearly two years after slamming the brakes on lucrative initial public offerings in Hong Kong and New York as part of a sweeping regulatory crackdown.

But bankers and lawyers say any rebound in foreign share sales will be limited and likely to favour Hong Kong as tense bilateral relations between Beijing and Washington loom large for most issuers.

“We might see some recovery in US IPOs from Chinese companies, but it’s hard to envision flows returning to their prime,” said Zhan Kai, a Shanghai-based senior counsel at Chinese law firm Yuanda. “The US capital market is irreplaceable in a way, but many Chinese companies haven’t fully healed from the trauma of geopolitical conflicts between China and the US.”

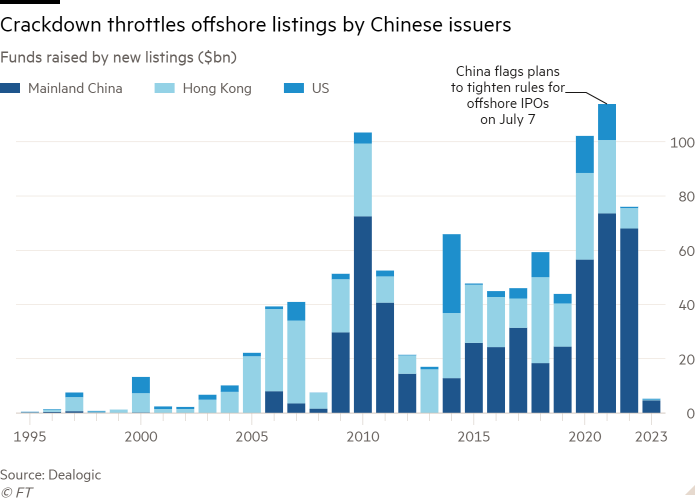

The cost of that lost business is likely to be measured in billions of dollars. For the two years before the crackdown, foreign listings by fast-growing Chinese technology companies raised more than $40bn each year, delivering annual fees of more than $1bn to investment banks, including Goldman Sachs and Morgan Stanley.

That all changed when ride-hailing group Didi Chuxing pushed ahead with a New York share sale in June 2021 despite Chinese regulators’ national security concerns. Days later, Beijing launched a crackdown on the tech sector that effectively halted all but a handful of offshore listings pending the publication of revamped regulations.

Almost 90 per cent of the $76bn brought in by Chinese IPOs last year was raised in Shanghai and Shenzhen, with Hong Kong accounting for almost all the remainder.

The new rules, published by the China Securities Regulatory Commission on Friday, provide the first unified regime for vetting and keeping tabs on companies that float abroad.

Before the crackdown, Chinese issuers could simply set up an offshore structure known as a variable interest entity to sell shares offshore. This allowed them to avoid the lengthy vetting process for onshore IPOs and skirt restrictions on foreign investment in certain sectors.

The new regime codifies the VIE structure, which now requires approval from the commission and other relevant regulators before the IPO process can begin.

Jason Elder, a partner at law firm Mayer Brown in Hong Kong, said the new regulations were “expected to have a positive impact” on the pace of offshore IPOs and “should streamline the path to listing for PRC-based companies and provide greater certainty for companies considering an offshore listing”.

But bankers said that companies were still wary of testing just how safe it was to sell shares abroad — especially in New York.

“Everybody is still in wait-and-see mode when it comes to applying for a US listing,” said one IPO banker at a state brokerage in Beijing. “These are new rules, and people still need to wait for the reshuffle of personnel at financial regulators.”

This was likely to happen after the annual meeting of China’s rubber-stamp legislature, which was scheduled to begin early next month, he added.

The shadow cast by US-China tensions — heightened most recently by China’s ties to Moscow and Washington accusing Beijing of flying a spy balloon over the US — also remains prominent for issuers. This is despite Beijing and Washington last year taking a major step towards resolving a stand-off over access to audit papers for Chinese companies listed on Wall Street.

A senior executive at one freight logistics services provider in China planning to go public later this year told the Financial Times that even with the new offshore listings regime in place, the group would “only consider Hong Kong and mainland listings” in order to avoid geopolitical risks.

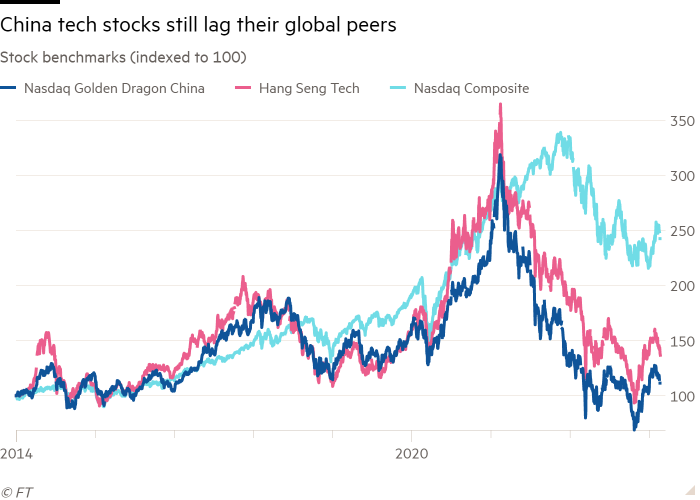

It might also be difficult to get large and more lucrative listings across the finish line, international asset managers said, because investor demand for Chinese equities had yet to fully recover.

“We haven’t seen big global institutional funds reassert their appetite for China investments yet, and that’s the exact type of investor you need for a large-scale IPO offshore,” said the head of institutional sales in Asia for one western asset manager. “Certainly, appetite is recovering somewhat, but people are still very wary.”

Chinese authorities have taken pains to indicate the long crackdown on tech groups is over, and in its announcement on Friday the commission said it “will support companies making use of both [onshore and offshore] markets . . . and unswervingly share the benefits of China’s economic growth with global investors”.

Yet investors and analysts have been alarmed by the recent disappearance of Bao Fan, the head of investment bank China Renaissance, which served as a bookrunner on many offshore listings — including the ill-fated Didi Chuxing float.

Andrew Collier, China country analyst at GlobalSource Partners, a consultancy, said the “Bao Fan [disappearance] shows this crackdown is not over”.

Bankers predicted that foreign listings would probably concentrate in Hong Kong, where perceived risk from regulators in both the US and China is lower.

“Hong Kong is desperate for that business to come back,” said Fraser Howie, an independent expert on Chinese finance. “The fact it’s outside the [capital controls] gives it a huge advantage that no other city in China has . . . Hong Kong is in that sense a natural favourite, even if I don’t see it going back to the golden days.”

“The US is definitely a no-go now and that will favour Hong Kong for sure,” said Federico Bazzoni, chief executive of investment banking at Vantage Capital Markets. But he added that reforms to streamline China’s onshore listings architecture, announced alongside the new offshore listings regime, could incentivise more issuers to choose a listing in the mainland over Hong Kong.

“The real winner in all of this could be the A-share market in China,” Bazzoni said, referring to shares that trade domestically in Shanghai and Shenzhen.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News