Commodity Traders Saw $100 Billion Year as Market Boomed, Says Report

Article content

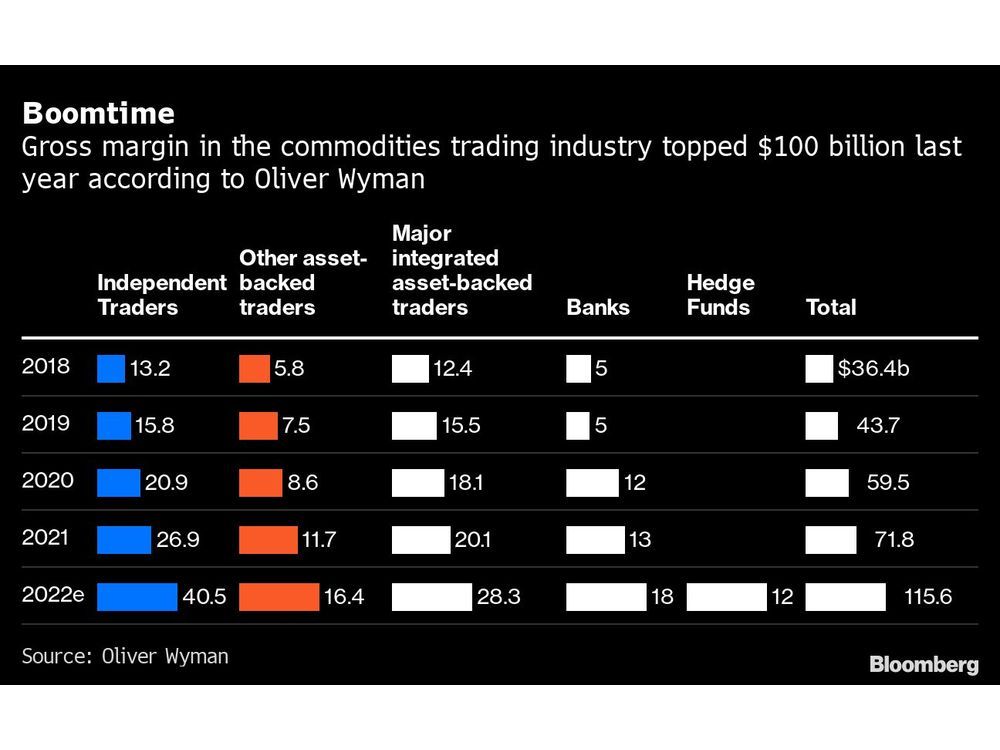

(Bloomberg) — Commodity traders likely saw a record $115.6 billion in gross margin last year on market volatility driven by Russia’s war in Ukraine, according to a new report.

Article content

If confirmed by trading companies’ annual profit figures — many of which haven’t been released yet — it would be a 61% increase over the previous year, consultants Oliver Wyman said in the study.

Article content

The aftershocks of Russia’s invasion a little over a year ago sent commodity prices from energy to metals and grains on a tear. That volatility, along with sanctions and export restrictions, created arbitrage opportunities for traders as the world’s energy and food supply maps were redrawn.

“Trading firms that spent years developing their portfolios, agile culture and expertise were well positioned to handle the disruption and keep commodities flowing,” the study said. It didn’t list individual firms.

Industry revenue has roughly tripled from the $36 billion in 2018, according to the report. Gross margins from independent trading houses far outstripped others in the sector. For the first time, the consultancy’s analysis split out hedge fund numbers into their own section, having merged them with others beforehand.

“Hedge funds more or less left commodities after 2010-2011, but over the last two to three years they’ve really built up their capabilities in a return to the market, and quite successfully so,” Ernst Frankl, who leads the firm’s global commodity trading and risk practice, said in an interview.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News