Don’t blame pipeline shortages — there’s plenty of capacity — for Canadian oil price collapse

Steep price discount related to issues Canada can’t control

Article content

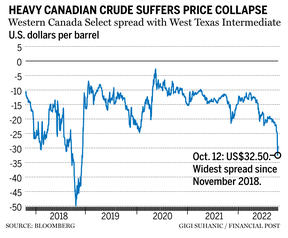

Canadian heavy crude prices plunged to their biggest discount to futures since 2018 and, this time, the collapse has little to do with a shortage of pipelines.

Advertisement 2

Article content

Heavy Western Canadian Select’s discount to West Texas Intermediate widened US$1.50 to US$32.50 a barrel at Hardisty, Alta., on Wednesday, the widest since November 2018, data compiled by Bloomberg show. That was just before massive pipeline bottlenecks prompted Alberta’s government to impose production caps on local oil companies. (As of Friday, the spread had closed somewhat to US$29.50.)

Article content

For years, Alberta’s oilsands producers blamed big discounts for Canadian heavy crude on the province’s lack of pipelines, forcing companies to sell at reduced prices locally. But a new export pipeline called Enbridge Inc.’s Line 3 that started operation last year has largely solved that problem.

Instead, today’s growing price discount is related to a broader set of issues that Canada has less control over, according to traders.

Advertisement 3

Article content

Maintenance and emergency shutdowns of major U.S. refineries in the Midwest, including BP PLC’s Whiting and Toledo refineries in Idiana and Ohio, mean less Canadian crude can be processed in its biggest market. At the same time, shipping disruptions on the Mississippi River are sparking fears refineries will have to curtail operations because the fuel they make can’t be shipped down the river.

With less Midwest demand, more oil is shipped south toward the U.S. Gulf Coast where new problems emerge.

High natural gas prices make refining heavy and high-sulphur crude oil more expensive, according to Vortexa data. At the same time, Canadian crude on the coast is exposed to discounted Russian barrels. India has cut its imports of Canadian oil by almost half since May as the country takes more Russian crude.

Advertisement 4

Article content

-

OPEC+ oil cuts could push world economy into recession, IEA warns

-

Alberta’s new premier puts Ottawa on ‘notice,’ vows to defend provincial control of oil and gas

-

Current energy shock is not transitory, says IMF

Canadian Cold Lake crude on the Gulf Coast traded at a record discount to WTI of US$23 a barrel early on Wednesday before strengthening in the afternoon to US$20.25 a barrel. The discount reached US$25 a barrel at Cushing, Oklahoma, before rebounding to a US$21.75 a barrel, according to Link Data Services.

Floating inventories of high-sulphur fuel oil off Singapore rose to year-and-half high the week ended Monday as Russian residual fuel flowed to Asia, Vortexa said in report. Asian residual fuel exports jumped to the highest in about two years in September. High-sulphur fuel oil at the U.S. Gulf Coast traded at more than US$31 below West Texas Intermediate at the Gulf, the largest discount in more than a decade, data compiled by Bloomberg show.

Bloomberg.com

_____________________________________________________________

If you liked this story, sign up for more in the FP Energy newsletter.

_____________________________________________________________

Advertisement

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News