Global equities climb as investors assess economic outlook

Global stocks rose on Tuesday, as traders moved back into riskier assets after the worst streak of weekly losses for equities since 2008.

Technology shares pushed Wall Street’s S&P 500 index 2 per cent higher, even as shares in Walmart — the world’s largest bricks-and-mortar retailer — slid over 11 per cent after inflationary pressures forced it to cut current-quarter earnings forecasts. Paramount Global and Citigroup — two shares revealed on Monday to have drawn investment from Warren Buffett in the first quarter — were both among the biggest risers.

The technology-heavy Nasdaq Composite added 2.8 per cent, after closing 1.2 per cent lower on Monday.

In Europe, the Stoxx 600 index ended the session 1.2 per cent higher, following on from a 3.3 per cent ascent for Hong Kong’s Hang Seng gauge. The region’s tech-focused sub-index rose 5.8 per cent as the heads of large Chinese technology companies met regulators to discuss the country’s digital economy.

Analysts at JPMorgan suggested that global equity markets had priced in too much recession risk, saying stocks “stand to recover if a recession doesn’t come through, given already substantial multiple derating, reduced positioning and downbeat sentiment”. The US bank is “sceptical” that April’s equity fund outflow — the highest since March 2020 — was the start of a long phase of outflows.

The FTSE All World index, which concluded six consecutive weeks of declines last Friday, rose 1.8 per cent on Tuesday.

Meanwhile, haven assets like the dollar and Treasuries sank as sentiment turned more positive.

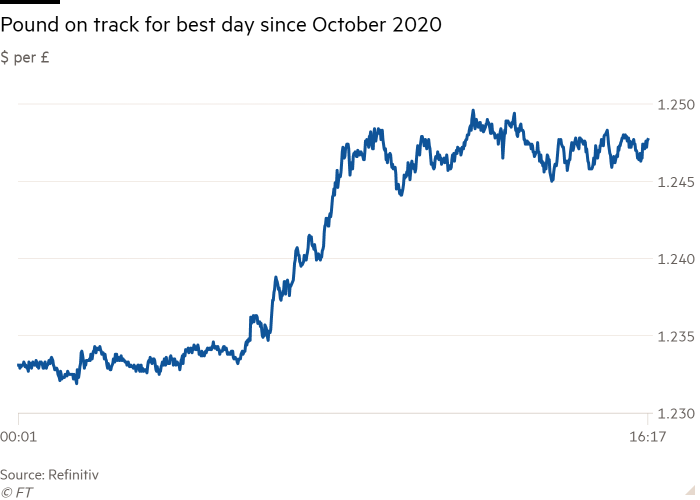

The dollar index — a measure of the US currency against six others — dropped 0.8 per cent, in a third day of falls, having hit multiyear highs last month. Compounding the greenback’s weakness, sterling rallied 1.3 per cent to just under $1.25, putting the pound on track for its biggest daily rise since October 2020. The euro rose by its most in more than two months, up 1.1 per cent to $1.05.

The common currency added to its gains after Dutch central bank chief Klaas Knot suggested that the European Central Bank should raise interest rates by 0.25 percentage points in July, but also remain open to a larger increase if inflation worsens. Markets are now pricing in a full percentage point of rate increases by the end of 2022, up from 0.93 percentage points on Monday.

As stock markets rose on Tuesday, sovereign debt was hit by a renewed wave of selling, sending yields higher. The yield on the 10-year German Bund, seen as a proxy for borrowing costs across the bloc, rose 0.11 percentage points to 1.04 per cent. The equivalent Italian yield added 0.12 percentage points to 2.96 per cent.

US debt also came under pressure, with the yield on the 10-year Treasury note adding 0.1 percentage points to 2.98 per cent and the policy-sensitive two-year yield rising 0.13 percentage points to 2.70 per cent.

The Federal Reserve raised interest rates by 0.5 percentage points this month, with similar-sized increases expected at the central bank’s next three meetings as it moves aggressively to curb stubbornly high inflation.

Treasury yields were little changed after Fed chair Jay Powell reiterated his message that the central bank will keep raising interest rates until there is “clear and convincing” evidence that inflation is declining.

“We still think the market is too aggressive on Fed hiking expectations,” said Steve Englander at Standard Chartered. The ECB is “just beginning to step up its language on normalisation and that is a big part of the dollar weakness that we expect in [the second half]”.

Additional reporting by Ian Johnston

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News