Global stocks fall after central banks push interest rates higher

Global stocks tumbled on Thursday as investors took fright at a wave of interest rate rises from central banks, who threatened more to come in the fight to tame inflation.

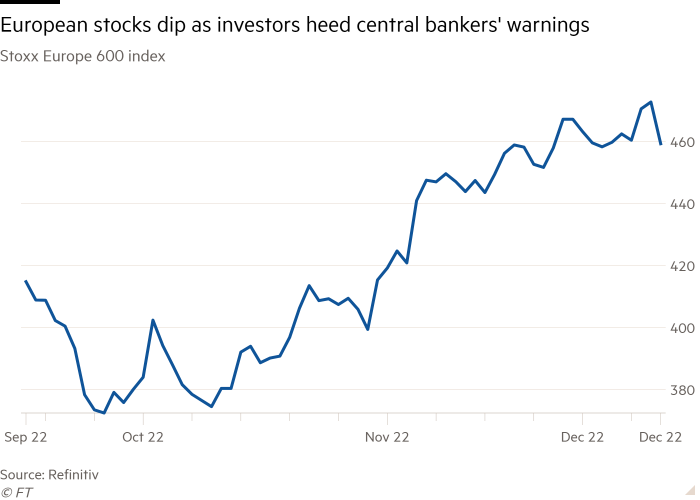

The benchmark S&P 500 was down 2.2 per cent on Thursday afternoon and the tech-heavy Nasdaq Composite shed 2.9 per cent. In Europe, the broad Stoxx 600 fell 2.8 per cent following hawkish warnings on interest rates from central banks in the US, UK, Europe and Switzerland over the past day.

The US Federal Reserve, European Central Bank and Bank of England all slowed the pace of rate rises, opting for 0.5 percentage point increases. But investors were rattled in particular by comments from the ECB that “inflation remains far too high” and that rates would continue to rise by 0.5 percentage points “for a period of time”.

On Wednesday, the Fed ended a run of four consecutive 0.75 percentage point increases, bringing the federal funds rate to a target range of between 4.25 per cent and 4.5 per cent. However, Fed chair Jay Powell said: “It will take substantially more evidence to give confidence that inflation is on a sustained downward path.”

The Fed’s mix of grim predictions and slowing interest rate rises have left some frustrated. “Either you believe your policy stance is ‘not sufficiently restrictive’ or you believe it is close enough that a [0.25 percentage point] hike is on the table for February,” said Steve Blitz, chief US economist at TS Lombard. “You cannot believe both.”

Seema Shah, chief global strategist at Principal Asset Management, said the market “still doesn’t seem to buy into the idea that the Fed isn’t going to cut rates through 2023 — there’s something about [Powell’s] messaging which isn’t quite resonating”.

Sentiment was further undermined by weak economic data, adding to fears of an impending recession. The US commerce department reported a fall in retail sales by 0.6 per cent month on month in November, the biggest drop in 11 months. The decline was more than the 0.1 per cent drop forecast by economists polled by Reuters. US industrial production declined 0.2 per cent in November.

The two sets of data indicate that the US economy “has lost some serious momentum, with the resilience of consumers to much higher interest rates starting to crumble”, said Andrew Hunter, senior US economist at Capital Economics.

Other data showed 211,000 Americans applied for unemployment aid in the past week. That was less than the previous seven-day period and lower than economists’ forecast, in a sign the tight domestic labour market could keep inflation elevated for longer.

The FTSE 100 fell 0.9 per cent as the BoE raised its rate to 3.5 per cent while warning that further rate rises were likely. Sterling slipped 1.8 per cent against the dollar to $1.22, down from a six-month high.

The euro traded 0.4 per cent lower against the dollar at $1.06 by mid-afternoon in New York, erasing earlier gains.

The yield on the two-year German government bond, which moves with rate expectations, rose to its highest level since 2008 — up 0.05 percentage points to 2.42 per cent.

In the Treasury market, the 10-year yield, which moves with growth and inflation expectations, was down 0.05 percentage points to 3.45 per cent. The two-year Treasury yield was roughly flat at 4.25 per cent.

Asian markets followed US equities lower, with Hong Kong’s Hang Seng index down 1.6 per cent, while Japan’s Topix lost 0.2 per cent and China’s CSI 300 traded flat.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News