Stocks Dip as Traders Brace for US Jobs Report: Markets Wrap

(Bloomberg) — Stocks in Europe and US equity futures struggled for direction as investors brace for the monthly US jobs report that’s likely to enliven the recession debate. The dollar rebounded from two days of declines.

Article content

(Bloomberg) — Stocks in Europe and US equity futures struggled for direction as investors brace for the monthly US jobs report that’s likely to enliven the recession debate. The dollar rebounded from two days of declines.

Advertisement 2

Article content

The Stoxx Europe 600 Index dipped, weighed by energy and media firms. Contracts on the Nasdaq 100 and S&P 500 erased an earlier advance to trade flat, with the Nasdaq stopping just short of a 20% rebound from its June low that would meet the technical definition of a bull market.

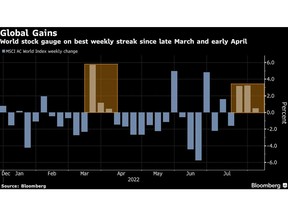

A global equity index is set for a third weekly advance and near a two-month peak in a recovery from bear-market lows, helped by resilient US company profits. The durability of the bounce remains in doubt as central banks around the world speed up rate hikes and risk economic downturns.

That’s even as the inversion between two-year and 10-year yields remains near the deepest since 2000, harkening imminent recession.

Stocks rebounded last month on speculation that runaway inflation may have peaked and the Fed can temper interest-rate increases. With US payrolls Friday data a closely-monitored Fed indicator, an above-expectation reading could provoke a negative reaction by traders because it would be seen as emboldening the US central bank to press on with outsized hikes.

Advertisement 3

Article content

Hiring likely softened in July but the labor market remains consistent with an expanding rather than recessionary economy and the Fed will persevere, according to Bloomberg Economics.

“The equity market in the last month has managed to turn both hawkish and dovish data into a reason for cheer, which obviously is rather self-serving and unsustainable in the medium term,” said James Athey, investment director at Abrdn. “I would continue to be a seller of equity strength given my view that the path for the economy most certainly remains down.”

The 10-year Treasury yield was steady at about 2.69% after sinking from an 11-year high of almost 3.5%. That’s driven a move back into defensive shares, especially tech stocks, that typically benefit from ebbing duration risk.

Advertisement 4

Article content

This week’s MLIV Pulse survey is asking about your outlook for corporate bonds, mergers and acquisitions and health of US corporate balance sheets through the end of the year. It takes one minute to participate in the MLIV Pulse survey, so please click here to get involved anonymously.

What to watch this week:

- US employment report for July, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 fell 0.2% as of 10:44 a.m. London time

- Futures on the S&P 500 were little changed

- Futures on the Nasdaq 100 were little changed

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index rose 0.8%

- The MSCI Emerging Markets Index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro fell 0.2% to $1.0225

- The Japanese yen fell 0.2% to 133.15 per dollar

- The offshore yuan was little changed at 6.7553 per dollar

- The British pound fell 0.3% to $1.2129

Bonds

- The yield on 10-year Treasuries was little changed at 2.69%

- Germany’s 10-year yield advanced two basis points to 0.82%

- Britain’s 10-year yield advanced two basis points to 1.91%

Commodities

- Brent crude was little changed

- Spot gold fell 0.3% to $1,786.75 an ounce

Advertisement

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News