US stocks turn lower after Fed raises rates by half a percentage point

US stocks turned lower on Wednesday after the Federal Reserve raised interest rates by half a percentage point, against a backdrop of cooling inflation.

Wall Street’s benchmark S&P 500 was down 0.4 per cent in choppy trading while the technology-heavy Nasdaq Composite slipped 0.5 per cent. The moves followed gains in the previous session after US consumer price inflation eased more than expected in November to its lowest level in almost a year.

The Fed’s unanimous decision on Wednesday took its so-called target range for interest rates to 4.25 per cent to 4.5 per cent. It also ended a string of larger 0.75 percentage point increases, as the US central bank aggressively tightened monetary policy to curb inflation.

Markets were on Wednesday pricing in expectations that interest rates in the world’s largest economy would peak at 4.88 per cent in May, up from 4.80 just before the Fed announcement.

The Fed announcement came alongside a revised “dot plot” of officials’ individual interest rate projections, signalling support for further tightening next year.

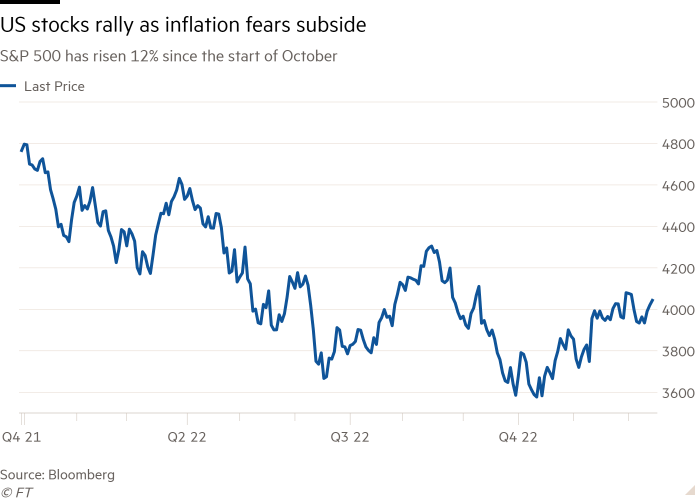

The S&P 500 is on track for its biggest three-month gain since the second quarter of 2020, having risen more than 12 per cent since the start of October, though some analysts doubt how long left the rally has to run.

“Given stocks don’t typically see a turning point until rate cuts are on the horizon, we still don’t believe a sustained rally is likely over the next three to six months,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, before the Fed announcement.

The dollar fell 0.1 per cent against a basket of six peers, having dropped more than 1 per cent in the previous session.

An index tracking the US currency has drifted lower in recent weeks but remains more than 8 per cent higher for the year to date, buoyed by the Fed’s rate rises and its traditional status as a haven in times of economic and market stress.

In government bond markets, the yield on the benchmark 10-year US Treasury note added 0.04 percentage points to 3.54 per cent. The two-year yield, which is sensitive to changes in interest rate expectations, also rose 0.04 percentage points to 4.27 per cent. Yields rise as prices fall.

Treasuries had rallied on Tuesday after the softer than expected consumer price index data, which gave a reading of 7.1 per cent for November — down from 7.7 per cent in October.

Elsewhere in equity markets, the regional Stoxx Europe 600 was marginally lower and London’s FTSE 100 slipped 0.1 per cent, despite UK inflation slowing to 10.7 per cent in November, down from 11.1 per cent in October.

“The inflation number in the UK came in better than expected but let’s not forget what level it actually is,” said Neil Birrell, chief investment officer at Premier Miton. The Bank of England, which meets on Thursday, “isn’t about to suddenly get dovish off these big numbers and that’s probably what people are reflecting on”.

Asian stocks rose, with Japan’s Topix adding 0.6 per cent, South Korea’s Kospi gaining 1.3 per cent and China’s CSI 300 up 0.2 per cent after dropping earlier. Hong Kong’s Hang Seng index gained 0.4 per cent.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News