Wall Street stocks sink into bear market as growth concerns mount

Wall Street stocks fell into a bear market on Friday as mounting concerns over economic growth and inflation sent investors racing away from the world’s biggest equities market.

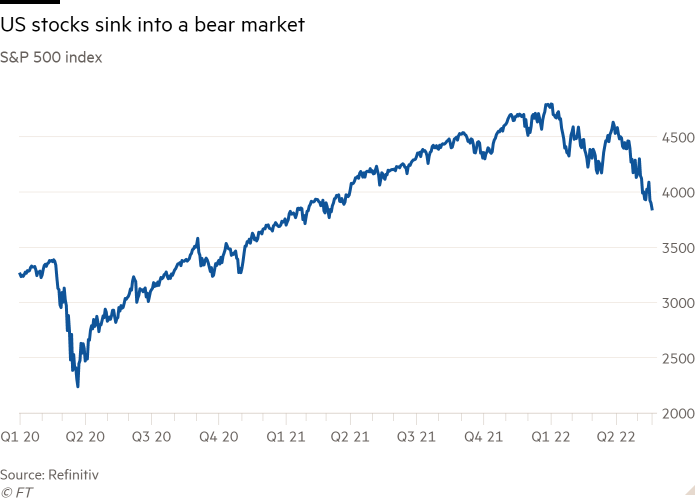

The S&P 500 opened higher but then came under pressure around lunchtime in New York, declining 1.3 per cent in recent trading. The fall left the index down by 20.3 per cent from the all-time intraday high set on January 4, marking the biggest drop since the lows set during the coronavirus crisis in March 2020.

Markets have been roiled by concerns over acute inflation, signs of slowing growth and central banks’ move to rein in the stimulus measures that have helped propel the global economy over the past two years.

“The strong consensus narrative is that growth goes down from here, there is a recession in the foreseeable future, interest rates will keep going up and inflation should come down but will remain high,” said Emiel van den Heiligenberg, head of asset allocation at Legal & General Investment Management.

Friday’s fall left the S&P 500 poised to close the week more than 4 per cent lower in the seventh-straight week of declines. The index has not sustained such a prolonged fall since 2001.

In a sign of the increasing worries sweeping across markets, investors yanked $5.2bn from global equity mutual funds in the week to Wednesday, bringing outflows over the past four weeks to around $16bn, according to a Goldman Sachs report based on EPFR data.

Exchange traded fund provider WisdomTree also reported net outflows this week from some typically resilient equity products, including those tracking the highest quality companies and high-dividend stocks, which are favoured during times of market tumult.

Traders, meanwhile, shifted in to haven assets, sending the yield on the benchmark 10-year US Treasury note down 0.06 percentage points to 2.8 per cent. The yield had reached a peak of 3.2 per cent last week.

“Markets are in a slow grind downward,” said Gregory Perdon, co-chief investment officer at Arbuthnot Latham. “It’s a combination of fear of a [Federal Reserve] mistake, if they raise rates too quickly, and fear that this inflationary trend is going to eat into spending, which then leads to a reduction in companies’ earnings.”

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News