93% of women are stressed about money. Building a cash reserve can help, experts say

There’s a wealth gap between women and men that has been stubbornly hard to shake.

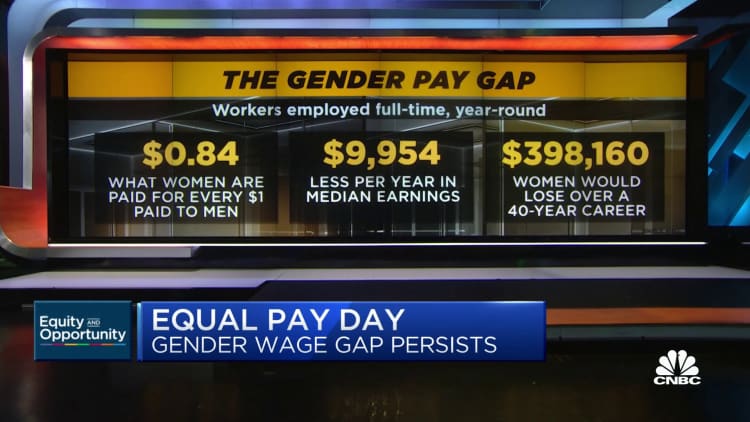

Gender pay gaps have persisted despite women’s increasing levels of education and representation in senior leadership positions at work. Women are still more likely to take time out of the labor force or reduce the number of hours worked because of caretaking responsibilities, often referred to as the “motherhood penalty.”

That contributes to a growing wealth discrepancy, which is difficult to escape, according to Stacy Francis, a certified financial planner and president and CEO of Francis Financial in New York.

Largely as a result of the wealth gap, women tend to be more financially vulnerable than their male counterparts. Regardless of their household income, 93% of women feel stress when it comes to money, according to a new report by Fidelity Investments.

Other reports show that many American women stay in marriages that are unhealthy and even border on dysfunctional due to financial insecurity.

Even in the healthiest relationships, women are likely to outlive men, Francis says, which is why she advises her female clients to consider that at some point, “They are going to be on their own.”

“Most all of us are going to be in the driver’s seat of our finances alone in the car at some point,” said Francis, who is also a member of the CNBC Financial Advisor Council.

While the benefits of saving are clear, for women, the ability to be independent is particularly powerful.

The benefit of a ‘f— off’ fund

In a viral 2016 Billfold piece, writer Paulette Perhach outlined the security that even a small cash reserve can provide. She recommended building up some savings that could be tapped even in a nonemergency and coined it a “f— off fund.”

“Whether the system protects you or fails you, you will be able to take care of yourself,” Perhach told CNBC. “It’s about creating options.”

In fact, financial stress levels drastically decrease with each additional month of emergency savings set aside, according to Fidelity. Roughly 81% of women with no emergency savings felt a fair amount or a lot of stress. Once women have three months’ worth of emergency savings, only 26% report high stress levels, Fidelity found.

How to build a cash reserve

Most financial experts recommend having at least three to six months’ worth of expenses set aside, or more if you are the sole breadwinner in your family or in business for yourself.

To get there, “start with baby steps,” Francis said.

“The best thing you can do is make room in your budget to have that money go toward your emergency fund in a consistent and sustainable way, so you don’t find yourself strapped,” Francis said.

Lorna Kapusta, head of women and engagement at Fidelity, suggests creating a budget with three main “buckets.” The goal is to put 50% of your income toward essential expenses, such as rent, food and utilities, another 15% toward retirement and 5% in an emergency fund, she said. The remaining 30% provides a cushion for a higher cost of living or other discretionary spending areas.

Even if you can’t reach those savings targets at the outset, commit to putting something in a high-yield account, many of which now pay more than 5% — the most savers have been able to earn in nearly two decades — and aim to increase it over time, she advised.

Similarly, contribute enough to your 401(k) to at least get the full employer match. Then, opt to auto escalate your contributions, which will steadily increase the amount you save each year.

Once an emergency fund is off the ground, most experts recommend meeting with a financial advisor to shore up a long-term strategy. Many employer-sponsored plans now offer counseling or one-on-one coaching. There’s also free help available through the National Foundation for Credit Counseling.

“One of the things that I talk to my clients about is the importance of establishing a personal financial plan,” said Judith Lee, senior vice president and wealth management advisor at Merrill Lynch. “Having a plan gives them a road map in terms of where they are right now and their individual goals.”

Ultimately, that money road map is key to feeling empowered, she added. “The specific choices one makes about savings and spending has an impact,” Lee said. “The discipline it takes to save is an acknowledgement to ourselves that we are worth the sacrifice.”

SIGN UP: Join the free virtual CNBC’s Women & Wealth event on March 5 at 1 p.m. ET, where we’ll bring together top financial experts to help you build a better playbook, offer practical strategies to increase income, identify profitable investment opportunities and save for the future to set yourself up for a stronger 2024 and beyond.

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||