2 Spectacular Warren Buffett Stocks That are No-Brainer Buys for 2024 (and Beyond)

Berkshire Hathaway CEO Warren Buffett has scored incredible investing wins over the years by picking great businesses with powerful competitive advantages. To put the Oracle of Omaha’s track record in perspective, if you bought $1,000 worth of Berkshire shares when Buffett purchased a controlling stake in the business and became its CEO in May 1965, you would today own stock worth roughly $34.3 million.

Of course, Berkshire’s current massive size makes it unlikely that its stock will deliver a performance like that again any time this century. With a market capitalization of $889 billion, it ranks as the world’s eighth-most-valuable company. Delivering exponential growth becomes far more difficult at that level.

But taking some pages out of Buffett’s investing playbook can still be a great way to score market-beating returns, and two Motley Fool contributors think following the Oracle of Omaha’s lead on these two stocks below would be a great way to strengthen your portfolio.

The AI revolution will power big wins for Amazon

Keith Noonan: Amazon (NASDAQ: AMZN) is the world’s largest online retail company. It’s also the leading provider of cloud infrastructure services.

Though it accounts for the large majority of the company’s revenues, Amazon’s e-commerce business actually does not account for most of its profits. Because of its high operating costs, the online retail unit generates relatively low profit margins. Its Amazon Web Services (AWS) cloud business is far more profitable, bringing in roughly 67% of the company’s $36.9 billion in operating income last year.

But as Amazon continues to leverage economies of scale and takes advantage of new technologies, it should be able to achieve far better margins from its e-commerce business. Notably, wider use of artificial intelligence (AI) should provide an incredible performance catalyst for the already hugely successful company.

AI will likely pave the way for increased automation at the company’s warehouses. It could also open the door for self-driving vehicles and autonomous-delivery technologies. As a result, Amazon’s e-commerce operating costs could fall dramatically — and its profits could skyrocket.

Meanwhile, the growing demand for AI is already powering strong performance for AWS. AI applications are being built, launched, and scaled on the company’s cloud infrastructure. As more applications are created and used, demand for that cloud infrastructure will continue to rise.

For long-term investors seeking AI growth stocks that offer an attractive risk-reward profile, Amazon has the makings of a great buy right now.

Coca-Cola has developed strong customer relationships

Parkev Tatevosian: To me, in order for a stock to be a no-brainer investment, I must feel confident that the company will be around for at least another two decades. Coca-Cola (NYSE: KO) certainly fits that bill. The beverage giant has been delighting customers for roughly a century, and it’s reasonable to assume it will be around for several decades more, at least. Importantly, Coca-Cola serves customers in a way that generates lucrative profits for shareholders.

In 2023, its revenue totaled $45.7 billion while its operating income totaled $13 billion. This means that after covering all the expenses involved in serving customers those tasty beverages they have come to love, Coca-Cola’s operating profit margin was a refreshing 28.4%.

The proven capability to generate billions in sales at lucrative profit margins can go a long way toward relieving investors’ concerns about the risks of investing. Certainly, billions in annual profits attracted Buffett to Coca-Cola stock. The underlying reasons that those profits keep flowing are management’s skill in operating the business effectively, combined with consumers’ brand loyalty and their steady consumption habits.

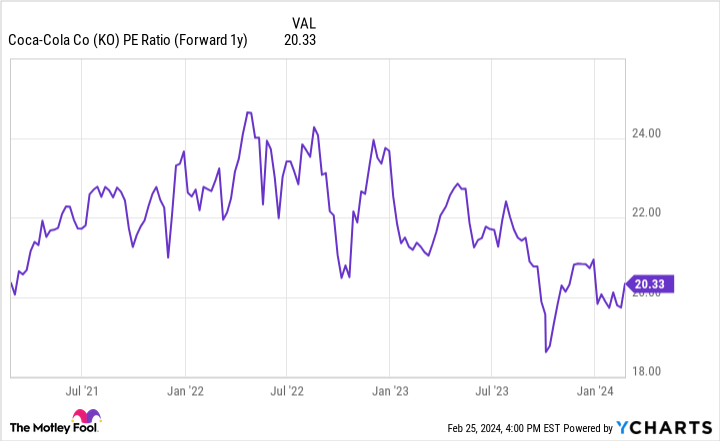

I am usually willing to pay a higher price to invest in companies like Coca-Cola because of the high chance they will be around for the long term. Fortunately, Coca-Cola’s valuation is not too expensive. Currently trading at a forward price-to-earnings ratio of 20, Coca-Cola’s stock has lately been at the lower end of the range it has occupied for the last several years. Investors who buy Coca-Cola stock today reasonably expect their investment to be worth more 20 or 30 years from now.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.

2 Spectacular Warren Buffett Stocks That are No-Brainer Buys for 2024 (and Beyond) was originally published by The Motley Fool

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||