Are stocks cheap enough to buy? BlackRock says they are after a brutal 2022

BlackRock, the world’s largest asset manager, has been making a case that U.S. stocks look “cheap” heading into 2023, even if equities might still need to find a bottom and earnings remain a wild card.

A chief reason? The S&P 500 index’s dramatic 20% decline on the year through Tuesday puts stocks on pace to post their worst year since the 38.5% plunge in 2008, according to Dow Jones Market Data.

“Bear market rallies can feel like cruel teasers of a turnaround,” BlackRock’s Tony DeSpirito, chief investment officer, U.S. Fundamental Equities, wrote in a first-quarter 2023 outlook on Tuesday.

But with signs that inflation peaked and S&P 500

SPX,

valuations reset lower, DeSpirito sees opportunities in equities, even if a mild recession hits and stocks fall further before finding a bottom.

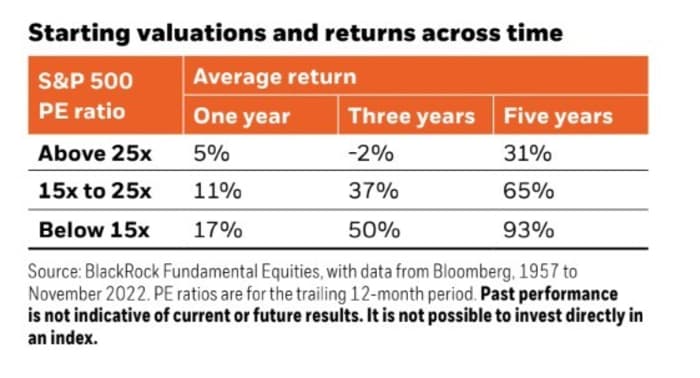

To help inform this view, DeSpirito’s team looked at how returns stacked up in the past 65 years based on the S&P 500’s trailing 12-month price-to-earnings ratio, a gauge of the value of a company’s shares based on earnings. The average one-year return was pegged at 11% (see chart) based on the S&P 500’s current 19.7x P/E range as of Nov. 30.

Stock market returns have been attractive at valuations in the current range

BlackRock, Bloomberg

It rose to a five-year average return of 65%. The S&P 500’s P/E ratio was cut dramatically this year from 24.7x at the end of 2021.

“Bottom or not, investors with a long-term mind-set have a decent entry point today,” according to DeSpirito. “We see an opportunity to capture value in stocks unduly punished in the downturn or those with quality characteristics that can offer greater resilience through a recession.”

The team thinks a mild recession is likely, but cautioned the “new wild card” for stocks will be earnings. They pointed to households’ saving sinking to a “precariously low” 2.3% in October and “consumer lethargy” that’s been starting to set in after a year in which companies mostly passed increased costs from inflation onto consumers.

Read: Why the consumer is ‘critical’ for investors to watch in 2023 as bear market ‘not yet complete’

To that end, they expect to see a 10%-15% earnings decline for the coming recession period.

After a string of losing days, stocks turned higher Tuesday, with the Dow Jones Industrial Average

DJIA,

up more than 200 points, or 0.7%, the S&P 500 about 0.5% higher and the Nasdaq Composite Index

COMP,

up 0.3%, at last check, according to FactSet.

Also see: Corporate bonds on pace for worst year in history with negative 14% return

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||