Coinbase plunges 86% in 2022, amid FTX-inspired slump. But one analyst says ‘you have to have a multiyear time frame.’

Hello there and seasons greetings! This is Mark DeCambre, Editor in Chief at MarketWatch.

The hottest story in crypto land remains FTX, even as we hurtle toward 2023. It is a fast-evolving situation. Sam Bankman-Fried has been

undefined

from the Bahamas and the co-conspirators are starting to emerge.

We’ll get you up to speed on those developments and much more in the latest installment of DL before Christmas.

You can find me at @mdecambre. And, of course, happy Hanukkah, Kwanzaa, Christmas, Festivus, Three Kings Day and everything in between from us at MarketWatch and Dow Jones to you and your loved ones.

Quote(s) of the week

“‘They may be planting tomatoes on Mars by the time this guy gets out of the FCI.’”

“‘Let me reiterate a call I made last week: If you participated in misconduct at FTX or Alameda, now is the time to get ahead of it. We are moving quickly and our patience is not eternal.’”

FTX flipping

It is the “flipping” and not the “flippening” that have crypto watchers enthralled this week.

“Flipping” is the practice of inducing lower-level targets in a criminal investigation to turn on higher-level ones in exchange for reduced penalties.

It appears to be what has played out for Caroline Ellison, 28, and Gary Wang, 29.

On Wednesday, FTX co-founder and former chief technology officer Wang and Ellison, who ran hedge fund Alameda, pleaded guilty to charges related to their roles in fraud that contributed to the collapse of FTX, U.S. Attorney Damian Williams said Wednesday night. They are cooperating with the authorities.

Prosecutors with the New York’s Southern District charge that FTX founder Bankman-Fried hid the exchange’s financial problems from the public and defrauded investors out of over $1.8 billion. Ellison and Wang are accused of helping him do it.

“Both Ms. Ellison and Mr. Wang have pled guilty to those charges and they are both cooperating with the Southern District of New York,” William said.

Flipping the pair is bad news for 30-year-old Bankman-Fried and comes as he was extradited to the U.S. from Bahamas. He is said be arraigned in front of a federal judge “as soon as possible,” William said.

According to a separate but parallel complaint issued by the Securities and Exchange Commission, Ellison helped manipulate the price of FTX-issued crypto token FTT, which served as collateral for undisclosed loans from FTX customers’ assets to Alameda.

The SEC claims Wang created software to allow Alameda to divert FTX customers’ funds, and that Ellison used those funds for Alameda’s trading activity—a no-no in traditional money management.

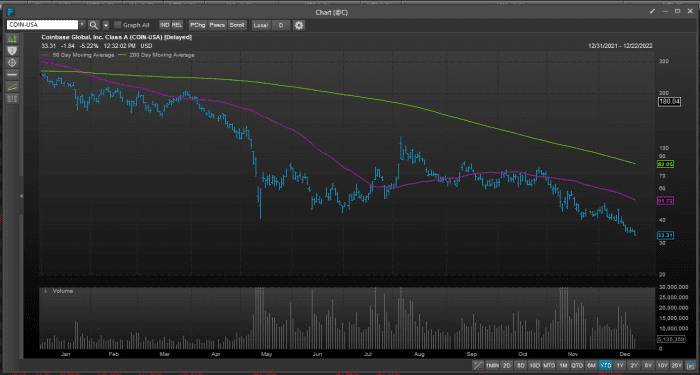

Wooden COIN?

Coinbase Global Inc.

COIN,

is down 87% so far in 2022, making it one of the worst stocks of the year.

FactSet

Despite that stunning downturn, MoffettNathanson analyst Lisa Ellis tells MarketWatch’s Emily Bary that the crypto exchange, the largest domiciled in the U.S., still has a promising outlook.

“This, in my view, is a pretty unique investment asset, but you have to have a multiyear time frame,” Ellis said.

Right now, Coinbase’s business is very oriented to retail trading, but the company has the potential to be “more of an infrastructure provider to the crypto economy” with opportunities in areas like clearing, settlement and cross-border trade, Ellis said.

A positive outlook may be a tough one for investors, or prospective investors, to fathom but it is worth noting that applications using blockchain technology continue, albeit a slower pace, and bitcoin, the No. 1 crypto, has held up fairly well despite the FTX drama.

Ellis has among the highest price targets, at $200, of analysts covering Coinbase, according to FactSet. Shares on Thursday were trading around $33.11, at last check.

Project Hamilton

Boston Fed Executive Vice President Jim Cunha said that a now-concluded “agnostic” project on central bank digital currencies, or CBDCs, known as “Project Hamilton,” has taken a critical early step “toward a deeper understanding of how money might work better for all.”

The project, the Boston Fed’s work on CBDC with Massachusetts Institute of Technology, is one that could help pave the way for a CBDC, sorting out whether it is viable.

“The OpenCBDC code base that resulted from this successful collaboration provides a credible and unbiased resource to evaluate design choices and ensure that a potential future CBDC could serve the public’s interest,” said Neha Narula, director of the Digital Currency Initiative.

OpenCBDC is “open” because the research paper and the code that powers the experimental CBDC architecture have been uploaded to GitHub, so other developers around the world can give feedback and refine the framework.

Back in September, Treasury Secretary Janet Yellen said the U.S. should “advance policy and technical work on a potential central bank digital currency, or CBDC, so that the United States is prepared if CBDC is determined to be in the national interest.”

CBDC differ from existing digital money, such as the balance in a bank account, because they would be a direct liability of the Federal Reserve, not a commercial bank.

Advocates of CBDCs believe it could be used to foster greater financial inclusion. However, crypto purists view CBDCs, potentially controlled by governments, as antithetical to the original concept of decentralized, permission-less platforms like bitcoin and other crypto.

Current crypto volatility means that prudent regulation will be needed if such initiatives are to move forward.

Crypto in a snap

Bitcoin has gained 3.4% during the past week, and was trading at around $17,397 on Thursday midday, according to FactSet.

Ether was up 3.54% over the same stretch to around $1,271.

Meanwhile, FTX native coins, known as FTT tokens, were down around 3% over the past seven days, trading at $1.36, according to data provider CoinGecko.

Notably, Binance’s native token, known as Binance USD, or BUSD, was flat over a seven-day period, Binance is the largest crypto exchange on the planet and its stablecoin has a circulating supply of around 19 billion BUSD and a total supply of 18.6 billion, according to CoinGecko.

| Biggest Gainers | Price | 7-day return% |

| XDC Network | $0.02593753 | 8.4 |

| OKC | $25.14 | 2.8 |

| Tether Gold | $1,750.38 | 0.8 |

| USDD | $0.982007 | 0.3 |

| Gemini Dollar | $1 | 0.2 |

| Source: CoinGecko as of Dec. 22 |

| Biggest Losers | Price | 7-day return% |

| Chain | $0.01942278 | -44.4 |

| Trust Wallet | $1.46 | -34 |

| Filecoin | $2.92 | -31 |

| Algorand | $0.167946 | -24.3 |

| Aptos | $3.61 | -23.3 |

Crypto companies, funds

Shares of Coinbase plunged 15% for the week to around $33. MicroStrategy Inc.

MSTR,

has fallen over 18%, at $161.54.

Crypto mining company Riot Blockchain Inc.

RIOT,

is down 9%, to $3.67, as of Thursday afternoon. Shares of rival Marathon Digital Holdings Inc.

MARA,

tumbled 23%, at $3.54, over the past week. Ebang International Holdings Inc.

EBON,

another miner nose dived over 40%, over the past week and was trading at $2.81.

Overstock.com Inc. shares

OSTK,

dropped around 15%, to $18.65, over the week.

Shares of Block Inc.

SQ,

formerly known as Square, skidded 13.7 %, to $59.15 for the week thus far. Tesla Inc. shares

TSLA,

were down 20% to $124.24.

PayPal Holdings Inc.

PYPL,

fell 6.3 % over that stretch, to trade at around $66.64. Nvidia Corp.

NVDA,

declined 13.7%, at $149.19, for the week.

Advanced Micro Devices Inc. shares

AMD,

were down 8.3% to $62.37 for the week, as of Thursday.

Among crypto funds, ProShares Bitcoin Strategy

BITO,

fell 5.9% to $10.33 Thursday, while its Short Bitcoin Strategy ETF

BITI,

rose 5.9% to $40.25. Valkyrie Bitcoin Strategy ETF

BTF,

gave up 5.9% to $6.51, while VanEck Bitcoin Strategy ETF

XBTF,

shed 6.1% to $16.58.

Grayscale Bitcoin Trust

GBTC,

slipped 1.3% to $8.09 on the week.

By comparison, the S&P 500

SPX,

is down 4.5% on the week so far, while the Dow Jones Industrial Average

DJIA,

is off by about 3.4%, and the Nasdaq Composite Index

COMP,

is off 6.2%, at last check Thursday.

Must reads

[ad_2]

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||