Is the U.S. housing market headed for a crash? ‘It all depends on how high rates go,’ mortgage veteran says.

The U.S. housing market has been flashing signs of revving back up this year after its stratospheric climb during the pandemic — this despite the Federal Reserve’s efforts to cool demand and force inflation lower with sharply higher interest rates.

The Dallas Federal Reserve Bank, a go-to source for mortgage and housing data, added to worries this week with a new report warning of potential spillover risks of a “deep global housing slide” should higher mortgage rates in the frothy U.S. and German housing markets trigger severe price corrections.

While the fear is that a sharp repricing of home values could deliver a blow to household wealth and the economy, one mortgage-industry veteran thinks the risk of a major meltdown in the U.S. housing market still looks relatively low, at least for now.

“I don’t see a collapse unfolding like we saw in the global financial crisis [of 2008],” said Tracy Chen, portfolio manager in the global fixed-income team at Brandywine Global Investment Management, referring to the wreckage unleashed in financial markets after home prices fell by over one-fifth on average from 2007 levels.

“Since then, we’ve had better underwriting standards,” Chen said. “Even now, the mortgage-delinquency rate is very low.”

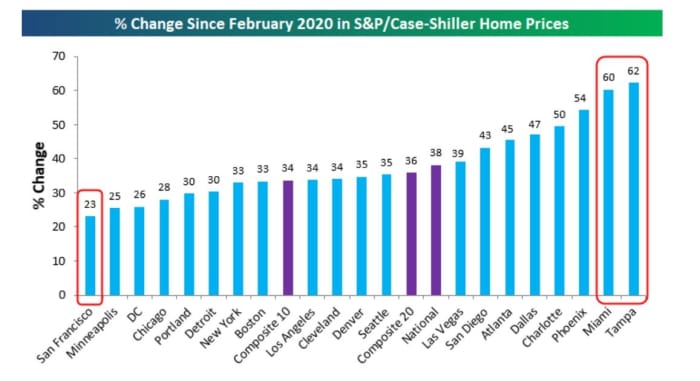

U.S. home prices have fallen 16% in San Francisco, the largest drop in the U.S., from their post-COVID peak in mid-2022, but prices are still up 38% nationally since February 2020 (see chart), according to a tally from Bespoke Investment Group, based on the latest S&P CoreLogic Case-Shiller indices.

U.S. home prices have a long way to fall before pandemic gains are erased.

Bespoke Investment Group, S&P Case Shiller indices

Chen, who invests in mortgage bonds and other structured credit, has been studying the rapid rise in housing prices globally since the start of the pandemic, looking for signs of trouble. Before she came to Brandywine, which oversees about $53 billion in assets under management, she was at UBS Investment Bank in structured credit and at GMAC Mortgage Group, where she focused on mortgage whole-loan pricing and trading.

Chen said some signs of a recovery have emerged in the housing market this year, if only briefly, including when in January the 30-year mortgage rate dipped to around 6% before heading back closer to 7.1% in the first week of March, according to Mortgage News Daily.

Despite higher borrowing costs, Chen also said the tone from homebuilders recently has been fairly upbeat, with foot traffic from potential buyers rebounding.

Still, housing remains a very rate-sensitive asset, she said. “It all depends on where rates go from here.”

A housing-market rut

“My view is that the U.S. housing market is stuck,” Chen said, noting that buyers remain hampered by low affordability and sellers haven’t wanted to budge much on price, given that the majority locked in historically low 30-year fixed rates of slightly more than 3%.

Those low fixed rates can provide existing U.S. homeowners with a big cushion to ride out a storm, even if the Fed’s policy rate needs to be raised above its current peak forecast of around 5% to keep pulling inflation lower.

Furthermore, while new-home sales matter, Chen noted that existing homes account for roughly 90% of the estimated $44 trillion U.S. housing market. In other words, existing-home sales drive the action — or stagnation.

Bill Adams, chief economist at Comerica Bank, said he expects the most likely path for housing this year will be a drop of more than 20% in sales of existing single-family homes, and a nearly 10% drop in sales of new single-family homes. His comments were prompted by the release Wednesday of a weekly Mortgage Bankers Association survey showing a third straight week of declines in mortgage applications.

Which brings concerns about the path of the U.S. housing market back to interest rates and inflation. “To me, it is easy to get inflation down to 4% or 3.5%,” Chen said. “But it’s extremely hard, and maybe impossible, to get it to 2%.”

Instead, she expects the Fed will need to raise its benchmark rate above 5%. “I don’t know if it will be 6% or 7%, but it will go higher.”

While higher rates will likely keep housing activity at bay, Chen worries that the bigger toll of high inflation and tighter lending standards will be felt acutely in consumer loans and in subprime automobile loans, where debt balances surged during the pandemic and where delinquencies have recently have been climbing.

Of note, the rate of seriously past due mortgage debt was 0.6% as of the fourth quarter of 2022, according to the Federal Reserve Bank of New York. It was 12.2% for subprime car loans in December, according to TransUnion data.

Stocks were higher Friday, with the Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

each on pace for weekly gains, shaking off earlier weakness as the benchmark 10-year Treasury rate

TMUBMUSD10Y,

topped 4%, but then retreated slightly.

Read: Inflation data pushed the 10-year Treasury yield above 4%. How much higher can interest rates go?

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||