Natural Gas Could Go From Widowmaker to Moneymaker: Here’s How to Play It

I can’t think of a more difficult speculative market than natural gas. However, it is a popular venue for traders because with big risks come significant opportunities.

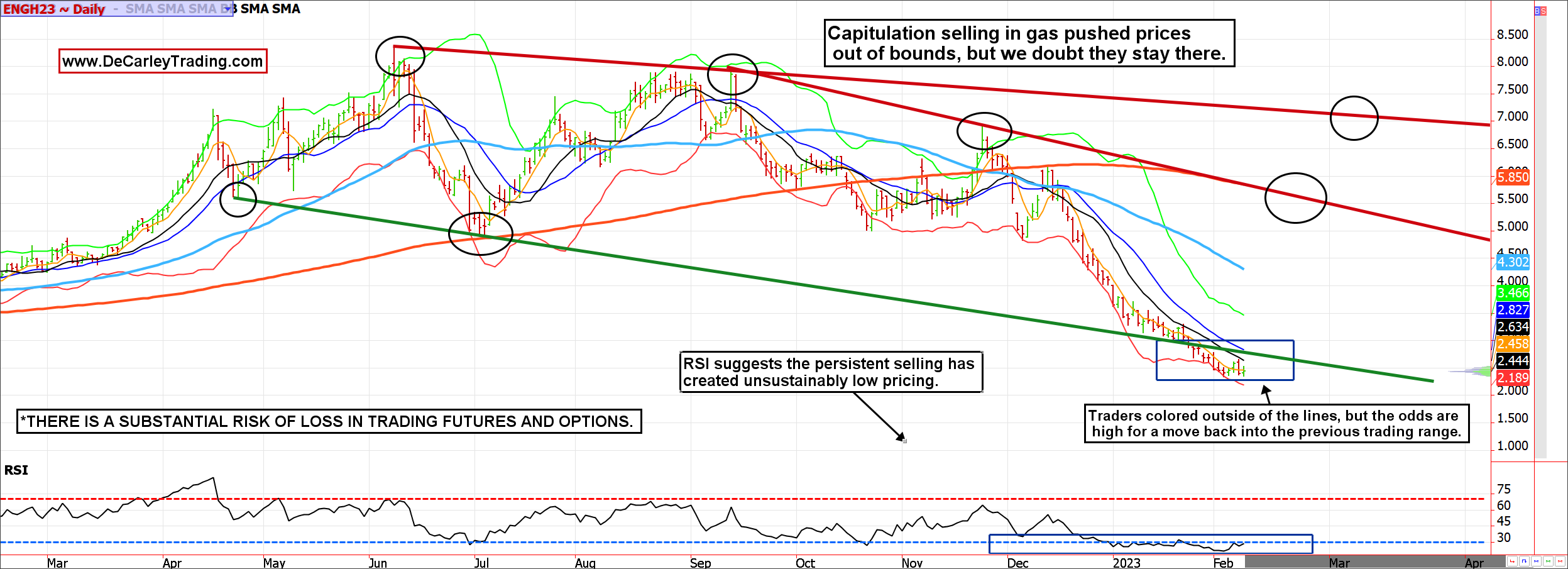

After peaking in 2022 near $10.00 per MMBtu the market has recently traded as low as $2.30. The roughly 80% plunge is indicative of a tech stock, not a commodity the majority of Americans use daily.

We’ve seen some wild things in gas over the years, but this is extreme, even for the market known as “the widowmaker.” Yet, just as we witnessed crude oil temporarily trade out-of-bounds in the spring of 2022 before reverting into a more natural price range, we believe the gas market is poised for mean reversion price action. This would mean a relief rally toward more sustainable prices at higher levels.

A commodity can trade at any price. There are no limits to what can happen in the short-term, but in the long-term, math has to make sense for producers, end-users, and market participants. Thus, eventually overstretched trends snap back to reality.

The gas market appears to be a victim of its own success. Speculative buying in futures and call options, which trigger what is known as a Gamma squeeze, forced prices to multi-year highs in 2022, but busts always follow commodity booms.

For clarity, a Gamma squeeze occurs when an underlying asset price begins to rally quickly in a short period, causing those who are short call options (usually market makers) to buy futures contracts to hedge option risk exposure. This process feeds on itself to generate a parabolic rally in the underlying futures market, such as those in natural gas last year.

The inevitable commodity bust occurs as the market undergoes a liquidation phase in the futures market. Still, it is also made possible by the fact that end-users pull forward the demand for a commodity as prices increase out of fear of a lack of supply or exponentially higher prices in the future. Accordingly, as the fundamental story that triggered the commodity rally fades, there is a lack of buyers and a sea of sellers.

Chart Source: QST

In the case of natural gas futures thus far in 2023, speculative selling has been exacerbated by margin call liquidation, panic, and the pain thresholds of bulls being reached. Specifically, on January 26, the gas market melted below a support level marked by the April 2022 low, the July 2022 low, and a few early-January lows.

In the trading sessions since, we’ve yet to see gas prices get off the mat. Prices are lingering below the trendline, with sellers showing up on every rally attempt. However, we aren’t looking at this as a downward breakout. Instead, we believe the market is being artificially held down by a liquidation event; margin call selling doesn’t care about price.

If that is the case, we should see gas prices make their way back above the downtrend line, which previously acted as support (currently near $2.75/$2.80). If prices can surpass this level, the market will likely resume trading in the pre-liquidation trading range. Depending on how fast the move occurs, this could be anywhere from $4.50 to $5.25 MBtuu.

In addition to gas prices being beyond their natural trading range, the RSI (Relative Strength Index) has fallen below 70.0 on both the daily and weekly charts. The daily chart is particularly interesting because the RSI has been perpetually in the basement since early January.

In my nearly twenty years of following commodities, I’ve only seen a market this oversold on a few occasions. Being Oversold doesn’t guarantee we flip from a bear to a bull market, but it dramatically increases the odds of a violent reversal once the selling dries up.

Bottom Line

Prices are temporary, as are the emotions tied to prices. If you find yourself long and wrong natural gas in any capacity, you are not alone, and I suspect time will eventually work in your favor. If you are flat and looking for an unusual opportunity for high-risk speculation, natural gas is worth a look.

Depending on account size and risk tolerance, it might make sense to buy an outright call option (maybe a June $4.25 call for about $800) or go long a mini futures contract (this contract makes or loses $25 per penny, or $2,500 per dollar, of price movement).

$2.00 natural gas probably isn’t sustainable. On average, over the last five years, gas has managed to find a bottom on or near February 9.

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

[ad_2]Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||