U.S. stock futures climb after markets dive to 5-week trough

U.S. stock futures gained ground on Monday, indicating Wall Street will strive to rally after falling to the lowest level since early November on recession fears.

How are stock-index futures trading

-

S&P 500 futures

ES00,

+0.29%

rose 15 points, or 0.4% to 3894 -

Dow Jones Industrial Average futures

YM00,

+0.24%

added 107 points, or 0.3% to 33235 -

Nasdaq-100 futures

NQ00,

+0.31%

climbed 47 points, or 0.4% to 11392

On Friday, the Dow Jones Industrial Average

DJIA,

fell 282 points, or 0.85%, to 32920, the S&P 500

SPX,

declined 43 points, or 1.11%, to 3852, and the Nasdaq Composite

COMP,

dropped 105 points, or 0.97%, to 10705.

The S&P 500 is down for two consecutive weeks, having fallen 5.4% over that period. It remains down 19.2% for the year to date.

What’s driving market

Equity index futures are inching up as the market tries to rally after Wall Street’s benchmark S&P 500 closed Friday at a five-week low.

Investors have become increasingly concerned of late about the recession they feel is all but inevitable given the determinedly hawkish stances of major monetary authorities, such as the Federal Reserve and European Central Bank, as they continue to battle high inflation.

Last week, alongside the Bank of England and others, the duo increased interest rates by 50 basis points to multiyear peaks, and the two stressed borrowing costs would likely go higher for longer than the market hoped.

“The Fed and ECB seem determined to leave a lump of coal in everyone’s stockings this holiday season,” said Stephen Innes, managing partner at SPI Asset Management.

“With economic data undershooting expectations, it’s not a stretch to think investors may shift their focus from inflation and the Fed to the growing impact that the Fed’s actions are likely to have on the economy in 2023,” Innes added.

The soft performance on Wall Street in previous sessions and worries about a global slowdown saw Asian stock markets fall back on Monday, with China’s Shanghai Composite

SHCOMP,

among the weakest amid more concerns about spiking COVID infections in the world’s most populous nation.

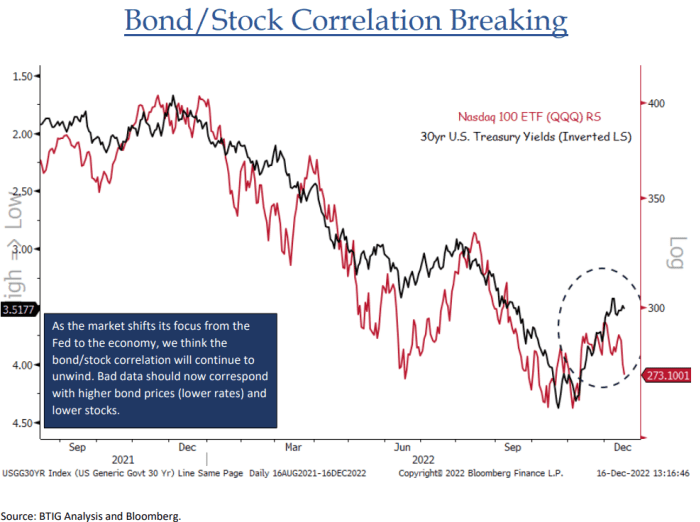

Analysts noted that investors had shifted from believing bad news on the economy was good news for both bonds and equities — because it discouraged central banks from being too aggressive in their policy tightening — and were now taking bad economic news for what it is, a scenario that may damage company earnings.

Source: BTIG

“The biggest change in markets over the last few weeks, in our view, is the shifting correlation between stocks and bonds. For most of this year bonds and stocks traded in tandem, as inflation ruled the roost,” said Jonathan Krinsky, chief market technician at BTIG, in a note to clients.

“Recently, that has pivoted and lower rates have been met with lower stocks, presumably on fears of economic slowdown. We expect that theme to grow louder into 2023,” Krinsky added.

U.S. economic updates set for release on Monday include the NAHB home builders index for December, due at 10 a.m. Eastern.

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||