Why is the stock market falling? Blame a ‘perfect storm’ as yields rise, dollar rallies

Rising Treasury yields appeared Tuesday to finally catch up with a previously resilient stock market, putting major indexes on track for their worst day so far of 2023.

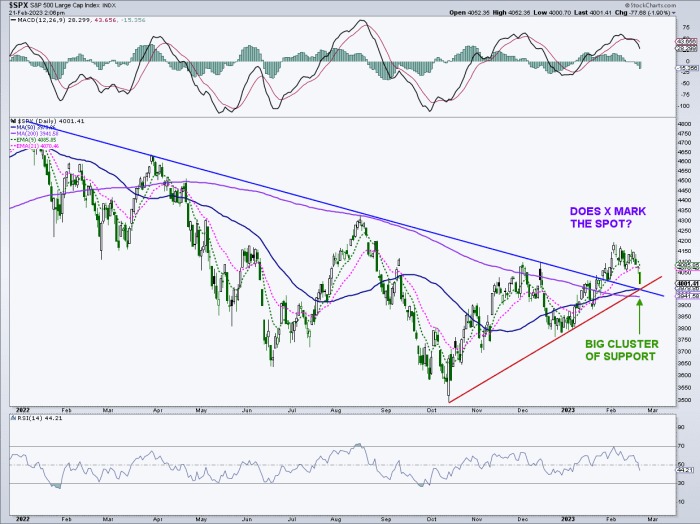

“Yields are popping across the curve, with the 2-year back to its November highs. This time it seems, market rates are playing catch up with fed funds,” said veteran technical analyst Mark Arbeter, president of Arbeter Investments, in a note.

Since the beginning of the month, traders in fed-funds futures have priced in a more aggressive Federal Reserve after initially doubting the central bank would hit its forecast for a peak fed-funds rate above 5%. A few traders are even pricing in the outside possibility of a peak rate near 6%.

Arbeter noted that markets generally lead fed-funds higher, not the other way around. Meanwhile, the U.S. dollar has also rallied, with the ICE U.S. Dollar Index adding 0.2% to a February bounce.

Arbeter also noted that breadth indicators, a measure of how many stocks are participating in a rally, had previously deteriorated, with some measures reaching oversold levels.

“Just another perfect storm against the equity markets in the short term,” he wrote.

Rising yields can be a negative for stocks, increasing borrowing costs. More important, higher Treasury yields mean that the present value of future profits and cash flow are discounted more heavily. That can weigh heavily on tech and other so-called growth stocks whose valuations are based on earnings far into the future. Those stocks were pummeled heavily last year but have led gains in an early 2023 rally, remaining resilient through last week even as yields extended a bounce.

Yields have been on the rise after a run of hotter-than-expected economic data, which have boosted expectations for Fed rate hikes. Weak guidance Tuesday from Home Depot Inc.

HD,

and Walmart Inc.

WMT,

also contributed to the tone.

Home Depot sank 6.5%, and was the biggest lower on the Dow Jones Industrial Average

DJIA,

after the home-improvement retailer reported a surprise decline in fiscal fourth-quarter same-store sales, guided for a surprise drop in fiscal 2023 profit and earmarked an additional $1 billion to pay its associates more.

“While Wall Street expects resilient consumers following last week’s robust retail sales report, Home Depot and Walmart are much more cautious,” said Jose Torres, senior economist at Interactive Brokers, in a note.

“This morning’s data offers more mixed signals concerning consumer demand, but during a traditionally weak seasonal trading period, investors are shifting toward a glass half-empty view against the backdrop of a year that’s featured the exact opposite so far, a glass half-full perspective,” he wrote.

The Dow remained down nearly 650 points, or 1.9%, while the S&P 500

SPX,

slumped 1.9% to trade at 4,001 after earlier dipping below the 4,000 level for the first time since Jan. 25. The S&P 500 was on track for its biggest daily drop since December. The Nasdaq Composite

COMP,

was down 2.4%.

The losses left the Dow clinging to a 0.1% year-to-date gain, while the S&P 500 remains up more than 4% and the Nasdaq Composite has rallied over almost 10% so far this year.

Arbeter identified a “very interesting cluster” of support just below the Tuesday low for the S&P 500, with the convergence of a pair of trend lines along with the index’s 50- and 200-day moving averages all near 3,970 (see chart below).

Arbeter Investments LLC

“If that zone does not represent the pullback lows, we have more trouble ahead,” he wrote.

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||