Biden warned on ‘heavy-handed’ ESG policies hitting companies, families

EXCLUSIVE – President Biden’s push to impose environmental, social and governance standards (ESG) on companies is imposing significant costs on companies and hurting families, Sen. John Thune warned Biden in a letter on Wednesday.

“While businesses may elect to pursue their own ESG agendas as part of a free-market society, the heavy-handed imposition from the federal government will have (and in some cases, already has had) negative real-world impacts on our economy and American families, especially by deepening the ongoing energy and inflation crises,” wrote Thune, R-S.D., in a letter reviewed exclusively by Fox News Digital.

“These efforts, though sold by administration officials as steps necessary to mitigate climate risks, are solely an attempt to strong-arm financial institutions and other firms into choking off capital to industries that are foundational to our nation’s economy, yet are continually villainized by the far left,” he wrote.

Thune said one example of overreach is the Securities and Exchange Commission’s proposed climate-disclosure rule that would not only require registrants to disclose information about their own greenhouse gas emissions, but, in many cases, report indirect emissions “from upstream and downstream activities (i.e., their suppliers and customers)” in their value chain – known as scope 3 emissions.

WHAT IS ESG? INVESTING WITH ENVIRONMENTAL, SOCIAL AND GOVERNANCE IN MIND

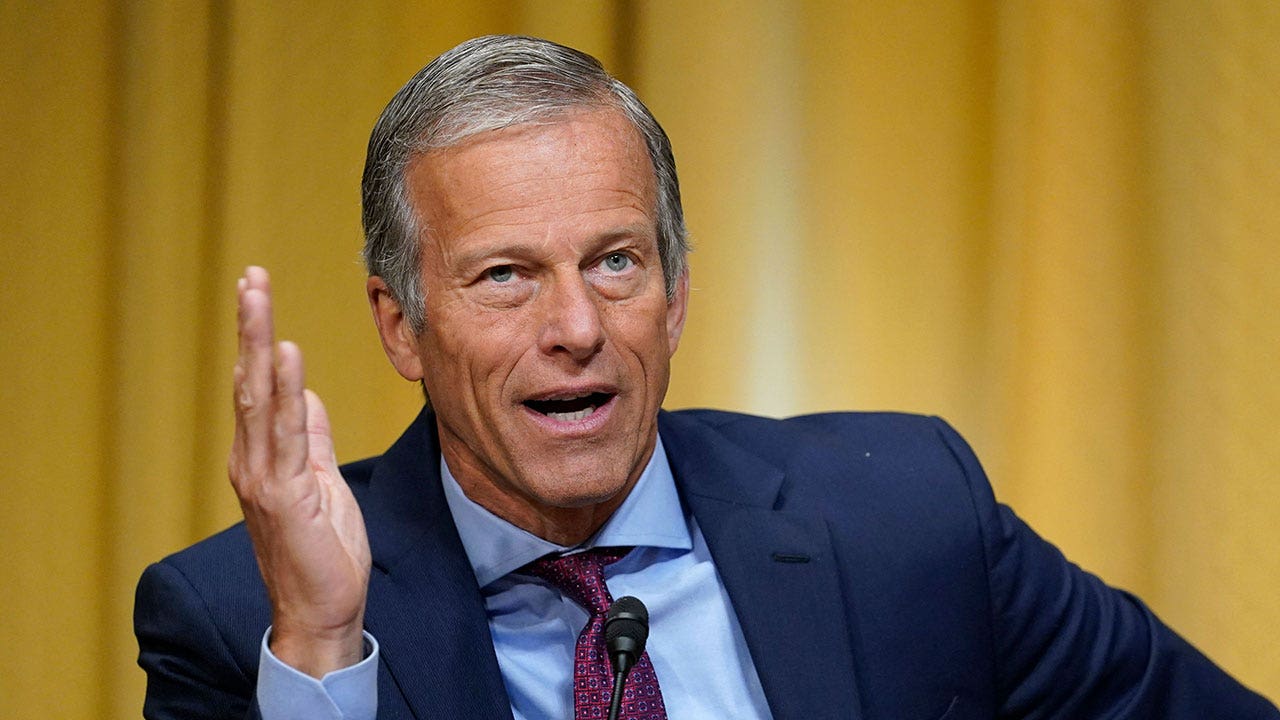

Sen. John Thune warned President Biden that imposing ESG policies is having a drastic impact on U.S. companies and families.

(Susan Walsh)

Thune said that rule would, “almost certainly reduce or potentially even eliminate businesses’ access to the resources they need to operate, as it would discourage firms from investing in or extending capital to them.”

“Equally alarming,” Thune said, is the recently proposed Federal Supplier Climate Risks and Resilience Rule that would require certain federal contractors to publicly disclose not only their greenhouse gas emissions, but also their scope 3 emissions, compounding the burden imposed by the SEC.

“Ultimately, private companies would be disincentivized to apply for these federal contracts altogether, which would increase project costs for the federal government and harm taxpayers,” Thune wrote.

Thune highlighted several other examples of how ESG priorities have infected U.S. financial regulators.

GOP INVESTIGATES WHETHER LEFT-LEANING ‘ESG’ GOALS HAVE INFECTED THE FEDERAL TRADE COMMISSION

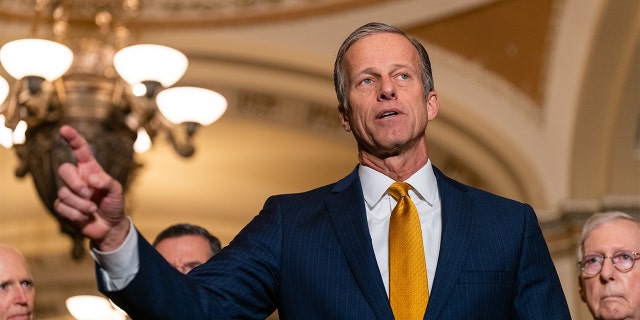

ESG requirements on financial institutions could choke off economic growth, Sen. John Thune warned.

(AP Photo/Susan Walsh, File)

SEC’S PROPOSED ESG RULE WILL LEAVE SMALL FARMS IN THE LURCH, LAWMAKERS FROM BOTH PARTIES SAY

Thune said the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation and the Federal Reserve have all published draft principles for climate-related financial risk management for large banks. The Department of Labor just finalized a rule that would require pension fiduciaries to consider climate change and ESG factors in making investment decisions, regardless of their financial relevance.

“And last, but certainly not least, the National Credit Union Administration published a since-rescinded strategic plan that seemed to recommend credit unions need to alter their field of membership and loan offerings in farming communities,” Thune said.

Thune warned Biden that while his ESG push is generally aimed at big banks on Wall Street, the president needs to recognize the “trickledown effect” those policies have on local community banks and credit unions which are “feeling the pressure from Washington” to comply.

Thune says that those community financial entities are worried about how the Biden administration’s environmental agenda “could impede their ability to lend to their clients and foster the growth necessary to steer our economy away from a recession.”

Sen. John Thune said the Biden administration needs to take the time to measure the costs of ESG policies on the economy.

(Eric Lee/Bloomberg via Getty Images)

“And in rural communities, community banks and credit unions are acutely wary of how your administration’s overreach could harm their ability to lend to their agriculture clients,” Thune wrote.

“It would be prudent for your administration to actually take the time to evaluate the costs its actions are directly and indirectly imposing on American businesses and families,” Thune said.

CLICK HERE TO GET THE FOX NEWS APP

“As our nation continues to grapple with record-high inflation, administrative actions that increase prices should be the last thing on your agenda,” he said.

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News