As lawmakers spar over Social Security, its costs are rising fast

WASHINGTON — President Joe Biden scored an early political point this month in his fight with congressional Republicans over taxes, spending and raising the federal debt limit: He forced Republican leaders to profess, repeatedly, that they will not seek cuts to Social Security and Medicare.

In the process, Biden has effectively steered a debate about fiscal responsibility away from two cherished safety net programs for seniors, just as those plans are poised for a decade of rapid spending growth.

New forecasts from the nonpartisan Congressional Budget Office, set to be released Wednesday, are expected to show Medicare and Social Security spending growth rapidly outpacing the growth in federal tax revenues over the next 10 years. That is the product of a wave of baby boomers reaching retirement age and beginning to tap the programs, which provide guaranteed income and health insurance from the time benefits are claimed until death.

Those retirees are an electoral force. In refusing to touch so-called entitlement programs, Biden was appealing to seniors, along with generations of future retirees, when he used his State of the Union address and subsequent speeches this month to amplify attacks on Republican plans to reduce future spending on Social Security and Medicare or potentially sunset the programs entirely.

“They’re more than government programs,” Biden told a Florida audience last week. “They’re a promise — a promise we made: Work hard and contribute, and when the time has come for you to retire, you’ll be there — we’ll be there for you to help you out. It’s been a sacred trust, the rock-solid guarantee generations of Americans have counted on, and it works.”

In his 2020 campaign, Biden proposed shoring up Social Security’s finances and increasing benefits for some retirees by raising taxes on high earners. Social Security is primarily funded through payroll taxes on workers’ incomes of up to $160,200. Biden has suggested eliminating the cap for incomes above $400,000 a year, subjecting them to payroll taxes.

Influential Republicans have proposed a variety of changes to make both programs more fiscally sustainable, including spending cuts and gradually raising the retirement age from 67 to keep up with longer life expectancy.

Republican leaders in Congress have stressed in recent days that, despite the calls from some conservatives to link safety net spending and the debt limit, they will not seek those changes as part of an agreement to raise the nation’s borrowing cap.

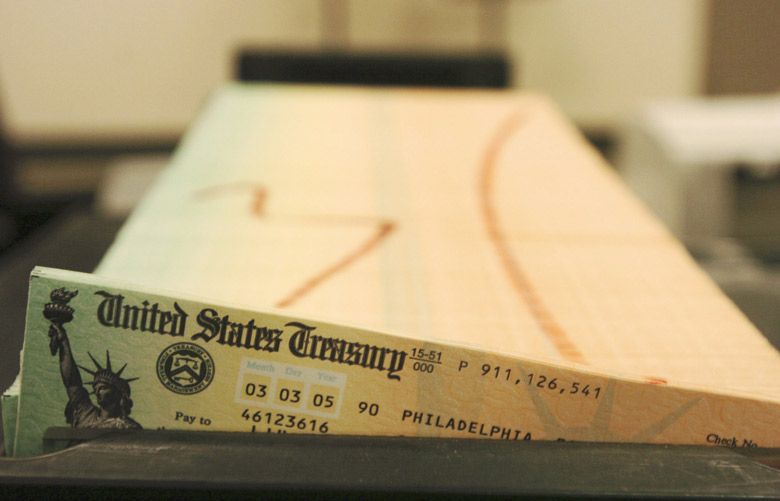

House Republicans have threatened not to increase the current $31.4 trillion limit, which the United States technically hit Jan. 19, unless Biden agrees to unspecified demands to reduce government spending and debt. If the cap is not raised and the government is unable to pay all its bills at once, some retirees might not get their Social Security checks as scheduled. But leaders say their demands to raise the cap will ultimately leave Social Security and Medicare intact.

Sen. Mitch McConnell of Kentucky, the minority leader, told reporters Tuesday that “there is no agenda on the part of Senate Republicans to revisit Medicare or Social Security, period,” adding, “I’ve noticed that the speaker of the House has said the same thing.”

If both sides hold their positions, the fiscal debate will narrow to Biden’s proposals to raise taxes on corporations and high earners — which Republicans have roundly rejected — and Republican proposals to cut the growth of a much smaller slice of federal programs.

Biden plans to address the deficit in remarks Wednesday in which he will criticize Republican proposals that he says would add $3 trillion to the debt. That includes repealing tax increases Biden signed into law in 2022, which would increase federal revenues, as well as making permanent several Republican tax cuts that are set to expire at the end of 2025.

That debate will exclude the primary spending-side drivers of future federal debt and deficits. Both Social Security’s and Medicare’s trust funds are spending more than they take in from payroll taxes and other revenue sources, a growing gap that is included in how the government accounts for the total size of its budget deficit.

In its last wave of forecasts, in May, the budget office predicted Social Security spending would grow by two-thirds over the coming decade. That’s more than double the expected growth rate for spending on the military and on domestic programs like education and environmental protection. High inflation could further accelerate that growth; Social Security enacted an 8.7% cost-of-living increase this year, its largest in decades.

By 2033, the May forecasts suggest, the federal government will be spending nearly as much on Social Security alone as it does on all discretionary spending — military and otherwise — combined.

Medicare is a smaller program but poised to grow even faster, at three times the rate of military and other discretionary spending over the next decade, according to the May forecasts. The new projections are likely to show its growth will be restrained somewhat by a law Biden signed last summer that is expected to reduce the program’s spending on prescription drugs for seniors.

The trustees of the programs predict Social Security’s main trust fund, for retirement benefits, will run out of money by 2034. At that point, the program’s tax revenues will be able to cover only about three-quarters of scheduled retiree benefits, though Congress could choose to make up the difference with borrowing or additional tax revenue. Medicare’s hospital trust fund is set to deplete its reserves in 2028.

Lawmakers could stabilize the programs by raising taxes, reducing spending or simply continuing to borrow money to keep paying full benefits. A group of liberal lawmakers led by Sen. Bernie Sanders, I-Vt., has a proposal to expand Social Security benefits and extend its solvency for 75 years through a variety of new taxes on investment and business income, along with earnings for Americans making $250,000 or more.

The conservative Republican Study Committee in the House has a plan that would raise the retirement age for both programs and reduce Social Security benefits for some higher-earning retirees.

Fiscal hawks in Washington, including think tank officials and some Senate Republicans, have said lawmakers must move now to find bipartisan agreement on plans to better balance the programs’ spending with tax revenues in the years to come. More than a decade ago, President Barack Obama, a Democrat, issued similar warnings.

“To put us on solid ground, we should also find a bipartisan solution to strengthen Social Security for future generations,” Obama said in his 2011 State of the Union address. “We must do it without putting at risk current retirees, the most vulnerable or people with disabilities; without slashing benefits for future generations; and without subjecting Americans’ guaranteed retirement income to the whims of the stock market.”

Some were dismayed that Biden — and Republican lawmakers — did not follow a similar path at his own State of the Union this month. “The sober warnings from the experts is quite a contrast to the gleeful cheers from bipartisan policymakers at the State of the Union for doing nothing,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget, which advocates federal debt reduction.

In his State of the Union address, Biden, who was Obama’s vice president, ripped Republicans for plans to cut safety net programs. Republicans in the audience booed him vigorously. After some back-and-forth with his critics, Biden declared victory.

“So folks, as we all apparently agree, Social Security, Medicare is off the books now, right? All right. We’ve got unanimity,” he said.

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News