Fight against ‘woke’ money managers emerges as a dominant issue in American politics

The movement to inject climate change and social justice politics into corporate boardrooms and investment strategies has suffered a series of setbacks in the past year, from getting shut out of a dozen states to getting pummelled by lawsuits and congressional investigations.

The road ahead only gets rockier with the Republican-run House ready to swat down new federal rules to apply what’s known as ESG to 401(k) investments.

The political left, meanwhile, isn’t giving up on institutionalizing this “woke” business ethos without a fight. Though, armed with little more than public relations campaigns, they have struggled to parry the GOP blitz against environmental, social and corporate governance investing or ESG.

Opponents warn that climate change and other political considerations warp an asset manager’s fiduciary duty to yield the highest returns on investment, most notably companies’ environmental impact, potentially imperiling retirement plans and public pensions.

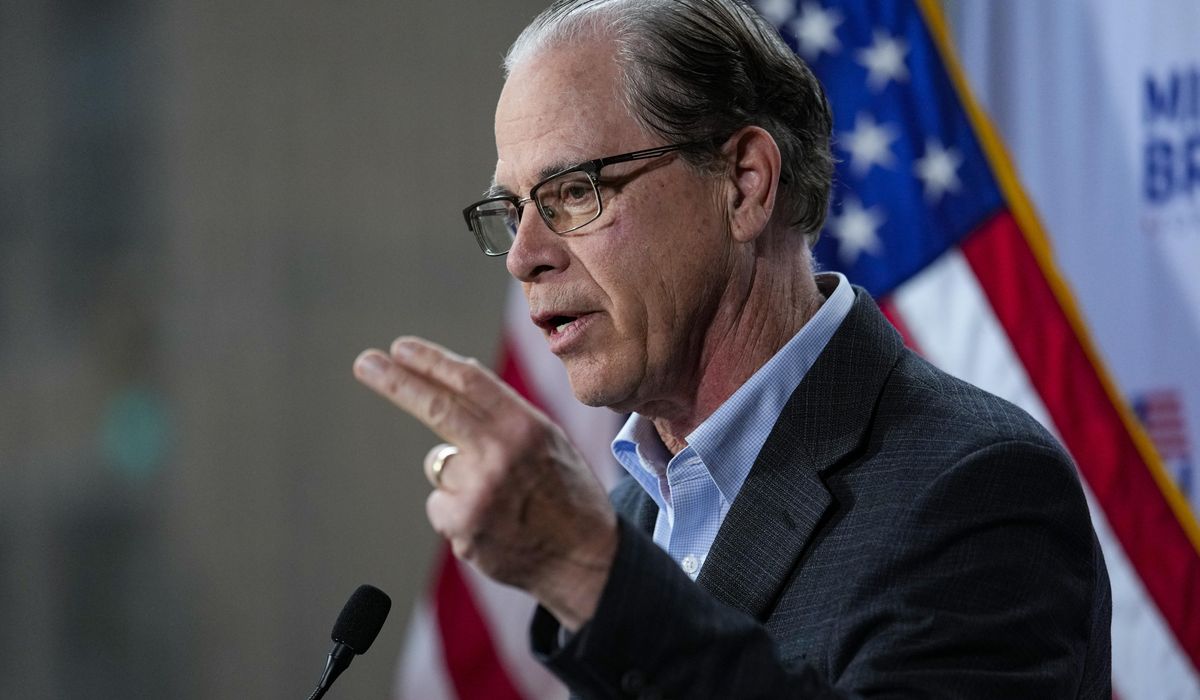

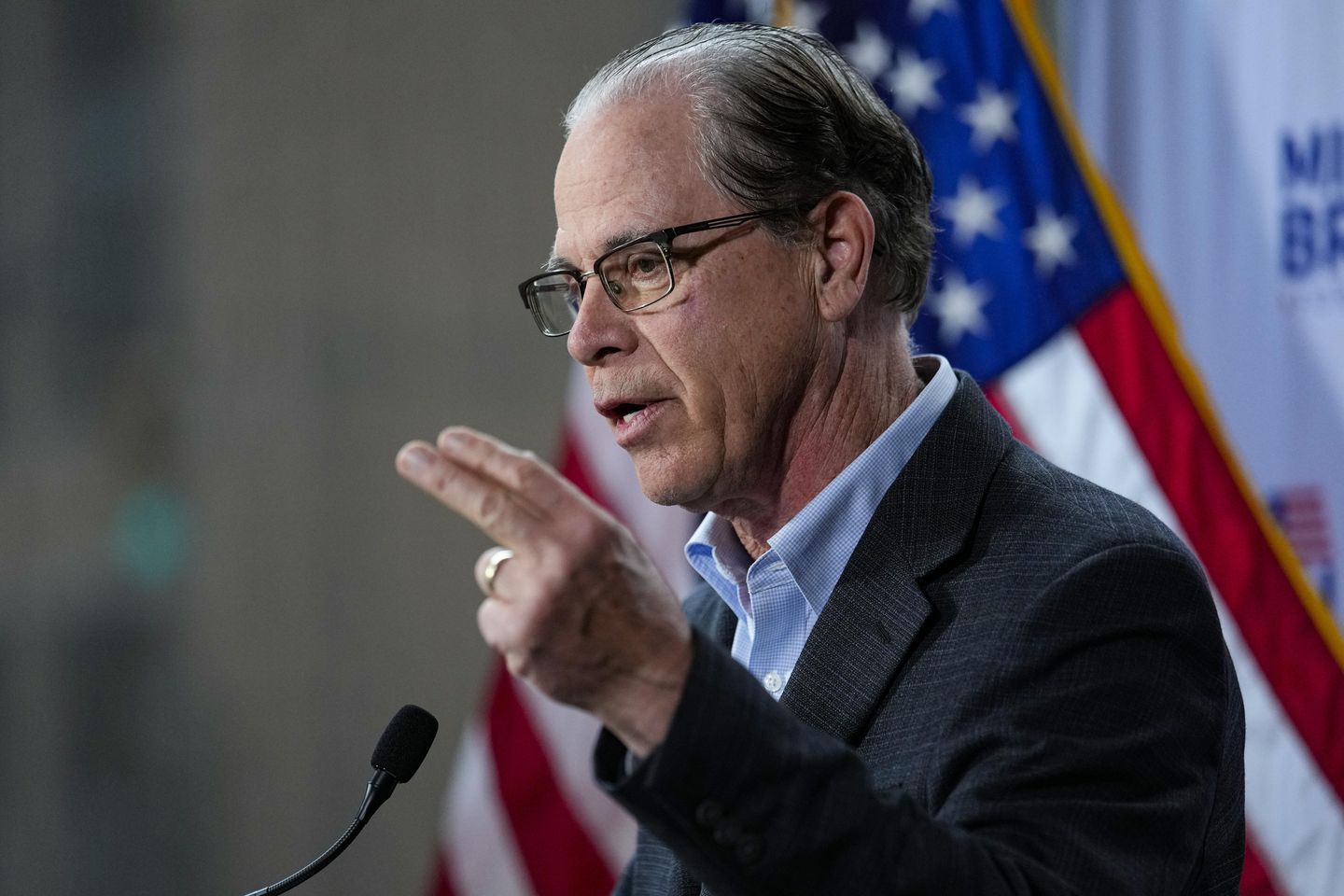

“Hell, I don’t want anybody who I’m turning my money over to have any consideration other than to give me the best return,” Sen. Mike Braun, Indiana Republican, told The Washington Times. “Pushing ideology through retirement and hard-earned investment funds does not make sense to me.”

Mr. Braun is leading an effort by all 49 GOP senators and Democrat Joe Manchin III of West Virginia to scuttle new rules from the Labor Department that allow 401(k) fund managers to engage in ESG investing, a move opponents argue would jeopardize the retirements of some 150 million workers and more than $10 trillion under the Employee Retirement Income Security Act of 1974.

Lawmakers are going after it using the Congressional Review Act, a tool for overturning new federal rules with a simple majority vote in both the House and Senate, which cannot filibuster it.

If it passes both chambers, President Biden has threatened to veto it.

“To be clear, the rule is not a mandate – it does not require any fiduciary to make investment decisions based solely on ESG factors,” the White House Office of Management and Budget said in issuing the veto threat on Monday.

The House on Tuesday will pass the Congressional Review Act resolution that was introduced by Rep. Andy Barr, Kentucky Republican.

But it’s a numbers game in the Senate, where Republicans need just one more Democrat to pass it. The vote must take place within 60 legislative calendar days from Sunday, the exact timing of which is at the discretion of Majority Leader Charles E. Schumer of New York.

Democratic Sen. Jon Tester of Montana and Independents Kyrsten Sinema of Arizona and Angus King of Maine — both of whom caucus with Democrats — are potential anti-ESG votes. All three are staying mum about their intentions.

However, if Democratic Sen. John Fetterman of Pennsylvania, who is being treated for depression, is absent from the vote, the resolution will pass with all 49 Republicans and Mr. Manchin.

The Labor Department’s ESG 401(k) rule is also facing a lawsuit by 25 GOP-controlled states led by Texas Attorney General Ken Paxton and Utah Attorney General Sean Reyes.

“These asset managers are violating their fiduciary duties by failing to maximize their returns and instead push a partisan political agenda,” Mr. Reyes told The Times. “The Biden rule weaponizes and politicizes the role of asset managers at a time when 401(k)s are already taking major hits due to economic downturns and high inflation.”

House Republicans also are probing ESG on multiple fronts, including with a Financial Services Committee task force and the creation of the “anti-woke caucus” by Republican Study Committee Chair Jim Banks of Indiana.

Financial Services Chairman Patrick McHenry of North Carolina and Rep. Bill Huizenga of Michigan, who is leading the anti-ESG task force, are among those demanding records and information from the Securities and Exchange Commission about its proposed rule for public companies to disclose climate risks and carbon emissions impacts for investors.

“We want to know from them what is going through their head when they’re doing this,” Mr. Huizenga told The Times.

He said to anticipate public hearings on ESG and testimony from investment firms about their climate-friendly strategies, in addition to informational sessions for other members to learn more about the topic that many lawmakers from both sides of the aisle know little about.

A myriad of red states has already passed laws that pave the way for divesting public pensions and ceasing other government business with pro-ESG financial institutions they deem anti-fossil fuel, with more GOP-led states eyeing similar proposals.

The latest on this front came from Florida Gov. Ron DeSantis, a Republican, who earlier this month unveiled legislation that would prohibit ESG banking, including the use of ESG in any business conducted with state or local governments.

Florida was also part of a coalition of red states that last year divested more than $4 billion from BlackRock, regarded as the ESG ringleader by Republicans.

BlackRock, one of the world’s largest asset managers, and other firms deny they are anti-fossil fuel despite their support of “climate-conscience” investment practices. BlackRock points to the more than $200 billion it has invested on behalf of clients in traditional energy companies as evidence.

Democrats and pro-ESG financial firms were caught flat-footed by the backlash against ESG, which they argue is crucial for achieving long-term investment returns in the face of a changing climate.

BlackRock responded to losing business because of its ESG stance with a public relations campaign. Other asset managers like Vanguard have tried to quell the ESG outrage by softening their positions, going so far as to call it quits late last year with the world’s largest climate finance alliance known as the Net Zero Asset Managers initiative.

House Democrats last month launched the “Sustainable Investment Caucus” in a bid to educate their colleagues about the potential benefits of green investing.

The caucus’s co-chairs, Reps. Sean Casten of Illinois and Juan Vargas of California, did not respond to interview requests for this report.

“We got to be honest: we are also creating this caucus for defensive reasons. One of the oldest rules in Washington is that losers cry louder than winners cheer,” Mr. Casten said when named co-chair. “When capitalism is working well but you’re not winning, you tend to call it woke capitalism. It’s still capitalism.”

[ad_2]

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News