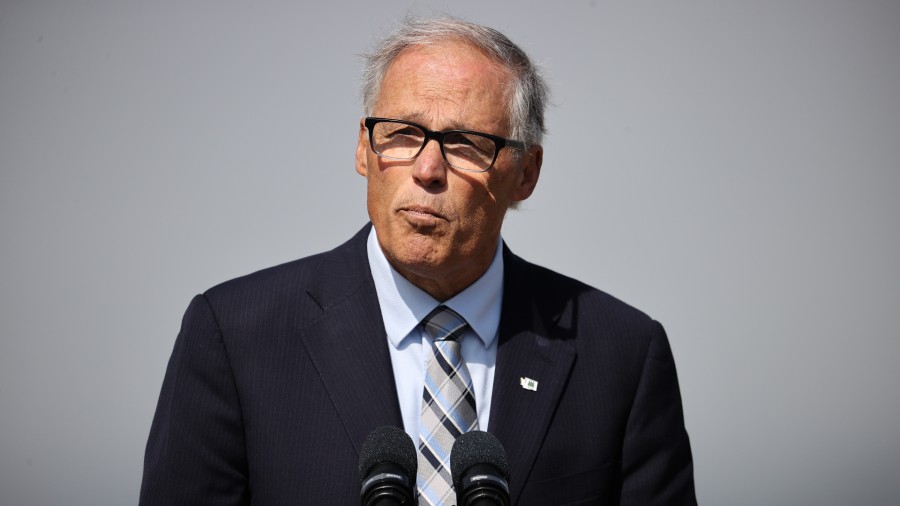

Rantz: Gov Inslee will use homelessness to push for income tax

Washington Democrats have been setting the stage for a state income tax for years. Now, Governor Jay Inslee is indicating it’s coming.

In an interview on TVW, host Austin Jenkins asked Inslee if he’d embrace a tax cut as other states have. But Inslee rejected the idea as quickly as he abandoned his old campaign promise not to raise taxes. He argues Washingtonians don’t need it because our state economy is “the envy of the United States” due to the “gangbuster industries doing very, very well.” He argued for those in need, there is the Working Families Tax Credit, anyway.

Inslee vastly overstates our economic strength. Gangbuster industries? He should check in with the healthcare and tech industries to see how they’re doing. And the tax credit he cites only offers a small credit to just a fraction of Washingtonians.

The real reason he opposes tax cuts? “We don’t have an income tax,” Inslee responded.

Rantz: Seattle must overcome delusional or naive homeless people and their enablers

Here comes the Washington state income tax

Inslee said it’s not fair to compare us to states that offered tax breaks to their residents.

“We have the lowest income state rate, income rate, in the United States, which is zero,” Inslee continued. “And so, when people compare us to other states, that’s the first thing we should look at. Those people are paying income tax, if they get a break on their income desk, ours is already zero, you can’t lower it any farther.”

He could push a general tax cut, which could impact everyone. In other words, it would fulfill his vacuous commitment to “equity” he constantly talks about. But this kind of equity is bad.

“With all due respect, our billionaires do not need a tax cut right now in the state of Washington. And when you give a general tax cut, you’re giving breaks to billionaires in the state of Washington. I don’t really think we need that right now,” he said.

Washington only has a small percentage of billionaires. But Inslee is willing to pass on helping the vast majority of the state because he loathes billionaires.

“The Governor made it very clear that he’ll unlikely ever propose broad-based tax relief since he believes the benefit the middle-class would receive is outweighed by his concern that the wealthy may also benefit,” Jason Mercier, director of the Center for Government Reform at the Washington Policy Center, told the Jason Rantz Show on KTTH.

The homelessness connection

The governor is effectively telling the public that if they want tax relief, they’ll have to accept an income tax. This will be a talking point he and Democrats use when they push through an income tax.

But Inslee and his advisors still know to expect push back on an income tax. After all, Washingtonians have consistently said no to one. And pushing through an income tax fundamentally changes the economic reality for every family. Consequently, he will make this about an investment in the homelessness crisis that Democrat policies caused.

Inslee noted in the interview that we have a homelessness crisis, unlike some of the states that passed tax cuts. He even acknowledges that the current crisis is relatively new, though he doesn’t seem to connect the dots between homelessness and new Democrat policies (drug decriminalization) and strategies (a hands-off approach to sweeping encampments).

“There are some things you can solve without dollars. Homelessness and mental health are not two of them,” Inslee said. “So we are responding to what I believe are Washingtonians’ desires to really confront the homelessness crisis and in effective ways, and that’s what we have proposed.”

The crisis deteriorated because Democrats allowed it to. But suddenly, they’re no longer ignoring the problem because they can use it to justify more taxes.

We should be cutting taxes, not creating new ones

Inslee and other Democrats consistently claim a lack of affordable housing leads to homelessness. While housing costs represent a small fraction of why someone is homeless, rather than an income tax that hurts middle- and high-income Washingtonians, they could actually lower the cost of living by making general cuts. It’s an approach State Representative Jim Walsh (R-Aberdeen) could endorse.

“For the last several years, the Washington economy has generated enough state taxes that Olympia has booked significant budget surpluses. Surpluses in the billions of dollars. We don’t need new taxes in this state,” Walsh explained to the Jason Rantz Show on KTTH. “Our existing ‘three prong’ tax structure (property taxes, sales taxes, and business “B&O” taxes) is more than enough. To give WA families meaningful tax relief, what Olympia needs to do is lighten up each prong.”

Walsh would also exempt the first $250,000 of a residence’s value from taxes.

“That will help homeowners living on a fixed income or tight budgets. It will also help renters by reducing the cost of residential properties, in general,” Walsh says.

He would also cut 1% from the state sales tax, and repeal the upcoming cap-and-trade and Low Carbon Fuel taxes. That would offer legitimate savings to the people hit hardest by the regressive taxes.

“If you’re concerned about regressive tax policy, the effective thing to do is lower and flatten existing taxes. It’s never a good idea to create new taxes to try to make tax policy fairer. That never works,” Walsh said.

Listen to the Jason Rantz Show on weekday afternoons from 3:00 p.m. – 6:00 p.m. on KTTH 770 AM (HD Radio 97.3 FM HD-Channel 3). Subscribe to the podcast. Follow @JasonRantz on Twitter, Instagram, and Facebook. Check back frequently for more news and analysis.

[ad_2]

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News