Shielding UK families from fuel bills crisis ‘could cost £100bn’; Brent crude back over $100 – business live

Shielding UK families from fuel bills crisis ‘forecast to cost £100bn’

The head of one of the UK’s largest energy groups is proposing a £100bn rescue plan to protect households from rising bills over the next two years.

Keith Anderson, chief executive of Scottish Power, has proposed capping household energy bills at about £2,000 a year.

Anderson’s proposal, which the Financial Times reports was made to business secretary Kwasi Kwarteng last week, underlines the scale of the crisis engulfing Britain from the unprecedented surge in gas prices.

Under the Scottish Power proposal, suppliers would cover the gap between the cap and the wholesale price of gas and electricity by borrowing from a “deficit fund”, which the government would arrange through commercial banks.

The cost would then be gradually paid off by the public – with through government borrowing or spread acoss bills (or a combination of the two).

The FT adds that:

People familiar with the discussions said the “mood music” in the government had shifted in recent weeks as gas prices have climbed, with Russia cutting supplies to Europe in retaliation for sanctions related to its invasion of Ukraine.

Ofgem is due to announce on Friday that the UK’s energy price cap will rise by roughly 80% in October, to around £3,550, from £1,971 today.

The cap is expected to jump again in 2023, with analysts at Cornwall Insight forecasting a rise to £4,101 in January – which could drive UK inflation as high as 18% early next year.

Key events

Filters BETA

The Institute for Government also warned that more energy bill support will be needed beyond this year, costing tens of billions of pounds more.

In their new paper outlining the government’s options, they say:

-

So far support is all focused on winter 2022/23, but current projections are for energy prices to be just as high, if not higher, next year.

The new prime minister will need to be ready to provide further support again. Offsetting the same proportion of bills next year would cost around £90bn. Given how long the crisis is expected to last, the government should also look at other measures to deal with the high energy bills, including investing in energy efficiency.

Rowena Mason

Ministers could face an additional £23bn price tag for covering extra household energy costs of £900 this autumn, rising to £90bn next year, a new paper by the Institute for Government has found.

The paper, looking at the options for Liz Truss or Rishi Sunak in No 10, also warned the government should plan for prolonged rises in energy bills by going a lot further in making public appeals to use less gas – for example by informing consumers about the cost savings from turning down thermostats – and in committing to building more energy efficient homes to help protect consumers.

No 10 and Kwasi Kwarteng, the business secretary and close ally of Truss, have been resisting appeals to the public to use less energy. However, the next prime minister, likely to be Truss, faces some very difficult choices on entering office on how far to subsidise energy bills.

The BBC’s Simon Jack has more details of Scottish Power’s pitch to ministers:

3/ …for the next two years.

£100 billion is Scottish Power’s best estimate of the difference between what it will actually cost to buy the energy and the current cap of £1971.

Sources close to the company said that Kwasi Kwarteng, tipped to be the next Chancellor….— Simon Jack (@BBCSimonJack) August 23, 2022

4/ ..if Liz Truss is next PM, was broadly receptive to the idea. Sources close to Kwasi Kwarteng wouldn’t be drawn on his enthusiasm. “We had a meeting about it – that’s all”.

The so called deficit fund would be repaid through bills over the next 20 or so years…— Simon Jack (@BBCSimonJack) August 23, 2022

5/ The presence of Ress-Mogg was seen as important as he’s a key ally of Liz Truss,

Energy cos are urging ministers to consider energy crisis needing COVID scale intervention. The furlough scheme which paid the wages of 11 million people cost around £70 billion.— Simon Jack (@BBCSimonJack) August 23, 2022

Keith Anderson, Scottish Power’s CEO, has STV News that the cost of energy must be frozen “now” ahead of a meeting with First Minister Nicola Sturgeon yesterday.

He proposed the same plan he set out before UK business secretary Kwasi Kwarteng and fellow UK minister Jacob Rees-Mogg, to freeze bills at current levels – at a cost of £100bn.

Scottish Power has proposed a £100bn plan to freeze energy bills for two years in the face of a crisis that is “bigger than the Covid pandemic”.

The energy giant, which supplies gas and electricity to more than five million customers, has warned that the looming jump in energy prices will be “truly horrific” for many people.

Shielding UK families from fuel bills crisis ‘forecast to cost £100bn’

The head of one of the UK’s largest energy groups is proposing a £100bn rescue plan to protect households from rising bills over the next two years.

Keith Anderson, chief executive of Scottish Power, has proposed capping household energy bills at about £2,000 a year.

Anderson’s proposal, which the Financial Times reports was made to business secretary Kwasi Kwarteng last week, underlines the scale of the crisis engulfing Britain from the unprecedented surge in gas prices.

Under the Scottish Power proposal, suppliers would cover the gap between the cap and the wholesale price of gas and electricity by borrowing from a “deficit fund”, which the government would arrange through commercial banks.

The cost would then be gradually paid off by the public – with through government borrowing or spread acoss bills (or a combination of the two).

The FT adds that:

People familiar with the discussions said the “mood music” in the government had shifted in recent weeks as gas prices have climbed, with Russia cutting supplies to Europe in retaliation for sanctions related to its invasion of Ukraine.

Ofgem is due to announce on Friday that the UK’s energy price cap will rise by roughly 80% in October, to around £3,550, from £1,971 today.

The cap is expected to jump again in 2023, with analysts at Cornwall Insight forecasting a rise to £4,101 in January – which could drive UK inflation as high as 18% early next year.

Introduction: Brent crude back at $100/barrel on

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

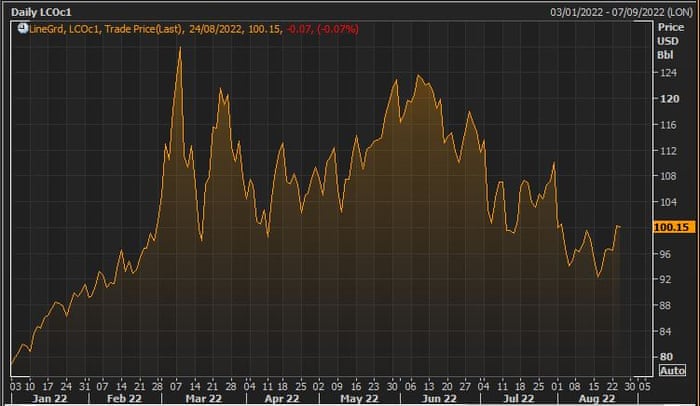

The threat of Opec production cuts has lifted Brent crude back to $100 per barrel, adding to the inflationary pressures on economies.

The benchmark oil price settled over $100/barrel for the first time in over a week last night, after Saudi Arabia dropped a heavy hint that the Opec group could cut production.

Brent had fallen as low as $91.50 earlier this month, down from $125/barrel in June.

And this has prompted Saudi energy minister prince Abdulaziz bin Salman to float the idea of OPEC+ output cuts to support prices.

Prince Abdulaziz warned there was “extreme” volatility and lack of liquidity in the oil market. That (he argued) means futures prices don’t reflect the underlying fundamentals of supply and demand, which could prompt the group to tighten production when it meets next month to consider output targets.

Prince Abdulaziz added:

“Witnessing this recent harmful volatility disturb the basic functions of the market and undermine the stability of oil markets will only strengthen our resolve.”

Oil markets seemed to get the message, with Brent crude jumping almost 4% on Tuesday, and holding its gains this morning.

As I end my shift Brent crude is up 3% and within sight of $100, a day after the Saudi energy minister raised the prospect of an #OPEC+ cut. Was this classic OPEC jawboning? Don’t know but, from an OPEC perspective, it seems to have worked! 🛢️📈

— Alex Lawler (@AlexLawler100) August 23, 2022

David Madden, Market Analyst at Equiti Capital, suggests any Opec move could depend on the progress of nuclear talks with Iran:

WTI and Brent crude are powering ahead as OPEC+ announced that it might consider cutting oil production, if or when, Iran boosts its output.

Western governments are engaging in talks with Iran about its nuclear programme, it is understood that little progress has been made, so OPEC might not be forced to act.

Also coming up today

The TUC is pushing for the UK’s minimum wage to be increased to £15 an hour, as soon as possible, to help millions of low-paid workers struggling amid the cost of living crisis.

My colleague Richard Partington has the details:

In a move that opens a fresh policy gap between unions and Keir Starmer’s Labour party, the TUC has thrown its weight behind calls for a more ambitious legal floor on pay rates. The union body said the government needed to draw up plans to get wages rising as workers suffer the biggest hit to living standards on record.

It said too many workers were living “wage packet to wage packet”, and a £15 minimum should be in place by at least 2030 but could be achieved sooner with a government that was serious about getting wages rising after years of sluggish pay growth.

The minimum wage is now set at £9.50 for those aged 23 and over, with lower rates for those who are younger.

The agenda

-

9.30am BST: The impact of sanctions on UK trade with Russia: June 2022 (from the Office for National Statistics)

-

Noon: Weekly US Mortgage Applications

-

1.30pm BST: US Durable Goods Orders

-

3pm BST: US pending homes sales

-

3.30pm BST: US crude oil inventories

[ad_2]

Share this news on your Fb,Twitter and Whatsapp

Times News Network:Latest News Headlines

Times News Network||Health||New York||USA News||Technology||World News