Egypt’s Pound Weakens in Black Market on Devaluation Bets

Article content

(Bloomberg) — Egypt’s pound has weakened more than 6% against the US dollar on the black market over the past week as traders bet on another devaluation amid mounting pressure on the North African nation’s currency.

Article content

The pound traded at about 33.5 per dollars Monday on the parallel market, compared to 31.5 early last week, a number of traders said. They’re seeking to hoard foreign currency before a potential devaluation of the official exchange rate, said the people who asked not to be identified.

Article content

Read: How to Know Where Egypt’s Once-in-Decade Crisis Is Heading

The Middle East’s most populous country has already devalued its currency three times in the past year and says it’s shifting to a more flexible exchange rate. Previous plunges have been followed by long stretches of stability. The pound was trading at around 30.73 per dollar in the official market Monday.

Derivatives traders are also bracing for a further decline. In the non-deliverable forwards market, the one-month contract on the pound has slumped about 3.5% since the end of February to 32.4 per dollar, while the 12-month contract is at 37.6.

Article content

Egypt is facing its worst foreign-currency shortage in years, with pressure being piled on the pound recently as the country struggles to attract foreign direct investments and overseas inflows into its local debt market.

Read: Egypt Puts State Assets Up for Sale to Hunt Foreign Exchange (2)

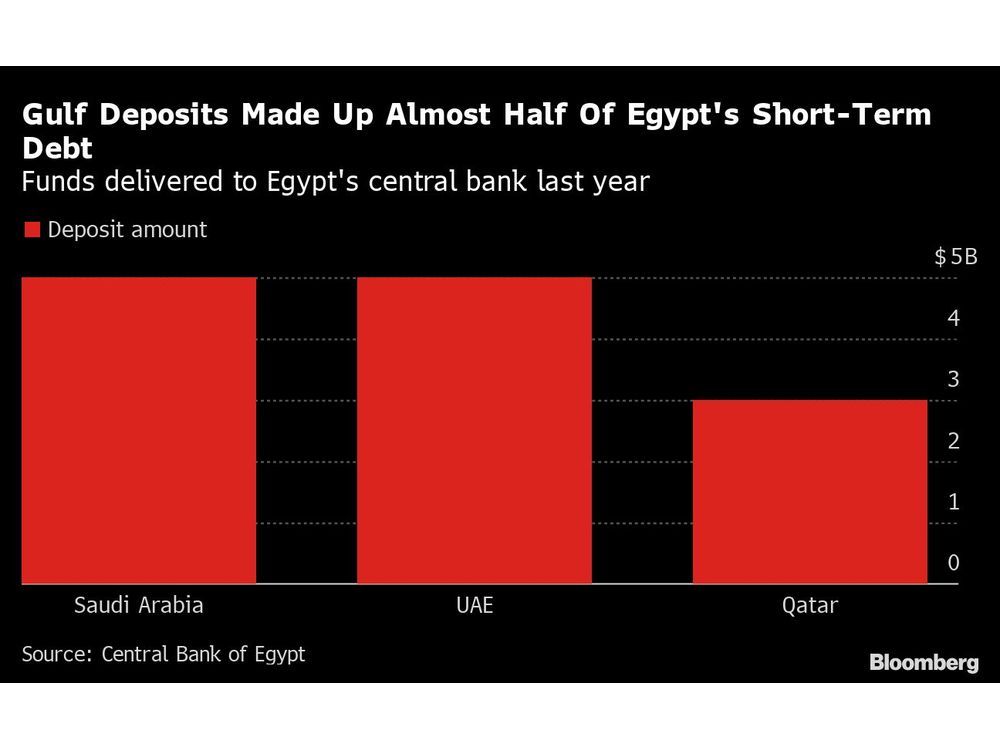

To shore up its finances, Egypt secured a $3 billion agreement with the International Monetary Fund as well as $13 billion of deposits from its energy-rich Gulf allies. Those countries are waiting for more clarity on the pound’s trajectory and proof that authorities are making deep economic reforms before delivering on further investment pledges.

Read: Gulf Powers Play Hardball Over Sending Billions to Rescue Egypt

The IMF estimates Egypt’s external financing gap at around $17 billion total over the next few years and expects its program will help unlock about $14 billion more from international and regional partners.

The latest devaluation, in January, temporarily froze activity in the black market. But trading is picking up again in expectation of another plunge in the official rate. Traders are keen to buy and hold dollars in the hope of larger profits later, said the people.

—With assistance from Netty Ismail.

Share this news on your Fb,Twitter and Whatsapp

Times News Express:Latest News Headlines

Times News Express||Health||New York||USA News||Technology||World News